IN THIS ARTICLE

Table of Contents

The insurance industry is no stranger to change. As technology advances and customer expectations evolve, insurers constantly seek ways to stay competitive.

However, streamlining operations and improving customer experiences while reducing costs and maintaining profitability may be challenging. Business process outsourcing (BPO) has emerged as a powerful tool for achieving these objectives.

If you are curious about BPO’s role in the insurance industry, this article is for you. It explores the advantages, services, and use cases of outsourcing in this sector.

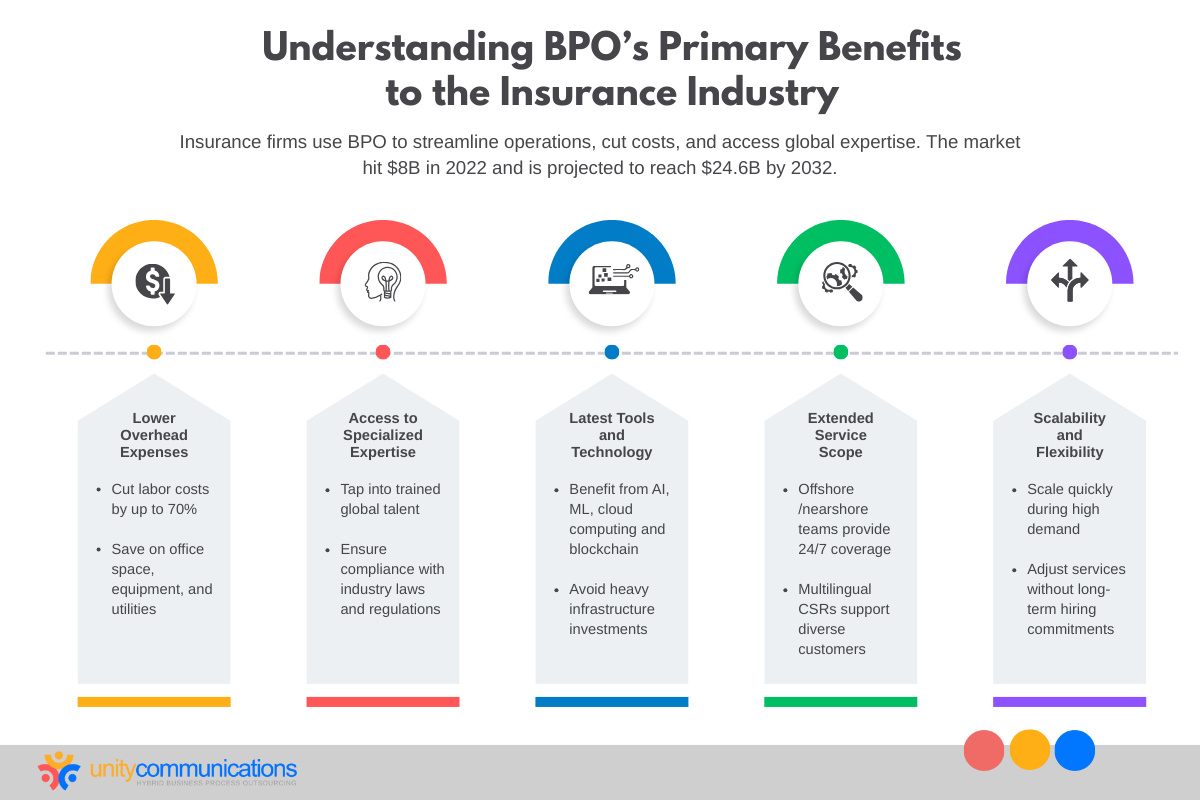

Understanding BPO’s Primary Benefits to the Insurance Industry

What is a BPO in the insurance industry? This approach involves delegating standard processes to an external provider. BPO takes on a more specialized form in the insurance sector, focusing on functions vital to the daily operations of insurance firms.

The primary objective of insurance business process outsourcing and its services is to improve productivity while reducing costs through:

- Lower overhead expenses. Outsourcing is known for its cost-reduction potential, especially regarding labor costs. Businesses that work with BPO providers report cutting labor expenses by 70%. Additionally, outsourcing mainly involves remote professionals, so it can help you save on office space, equipment, and utilities.

- Better access to specialized expertise. BPO providers have a global talent pool that excels in various industries, including insurance. They are screened and trained to ensure they have the skills and experience to perform tasks to a high standard. Outsourcing teams are also well-versed in applicable laws and regulations. For example, managing important documents such as a business COI is crucial to ensure compliance and mitigate risks within the insurance processes.

- Guaranteed acquisition of the latest tools. With the widespread use of technology and automation in the BPO industry, providers have tools to streamline processes. You no longer have to invest in your infrastructure. Common technologies in BPO include artificial intelligence (AI), machine learning (ML), cloud computing, and blockchain.

- Extended service scope. Partnering with an insurance BPO provider operating in offshore or nearshore locations gives you access to a round-the-clock team. It is one of the many advantages of time zone gaps in outsourcing. Geographical differences allow you to tap into a pool of multilingual customer service representatives (CSRs).

- Increased scalability and flexibility. With more resources for business process improvement, you can easily adjust your services to meet customer needs. Outsourcing allows you to scale operations to accommodate peaks and valleys in volumes without needing long-term commitments to hire and train new staff.

Due to their many benefits, outsourced insurance BPO services have become increasingly popular. In fact, according to Allied Market Research, the global insurance BPO market value reached almost $8 billion in 2022. Their data predicts the sector will expand to $24.6 billion by 2032.

Four Insurance Processes You Can Outsource to Start Your BPO Initiative

BPO providers in the insurance industry are excellent business partners because they can provide both front- and back-office outsourcing services. Thus, outsourcing can be a practical solution if you need help with customer-facing tasks or administrative functions for your insurance firm.

Here are some insurance BPO services you should consider.

1. Claims Processing

Third-party professionals typically work in a highly regulated environment and must comply with all applicable laws and regulations. They have a strong understanding of insurance policies and claims procedures.

BPO teams can help you with the following tasks:

- Claims intake

- Investigation

- Evidence gathering and review

- Liability and damages assessment

- Claims negotiation and settlement

- Policyholder payment issuing

They utilize the following tools to streamline claims processing:

- Case management software. This tool tracks claims statuses, manages deadlines, and assigns tasks to team members.

- Documentation automation tools. BPO teams use these tools to create standard documents, such as demand letters, pleadings, and discovery requests.

- E-discovery tools. The collection, processing, and review of electronic data can be streamlined with e-discovery tools. These tools also help identify relevant evidence and support claims.

- Legal analytics tools: Your insurance firm can use this software to identify trends and patterns in claims data. Improve process services and make better case decisions with the information gathered.

2. Policy Administration

Managing varying and complex insurance policies can be daunting. Errors and delays in this process could cost your firm. Partnering with a top-performing insurance BPO provider lets you accomplish this task efficiently and accurately.

Outsourcing teams can manage all aspects of the insurance policy lifecycle, such as:

- Policy onboarding

- Policy issuance

- Premium collection and management

- Policy changes and endorsements

- Policy renewals

To ensure accuracy and efficiency, insurance BPO companies utilize the following tools:

- Policy administration systems. Using this tool allows you to automate the entire policy administration process. Popular programs include Oracle, Pega, and FINEOS.

- Document management systems. This tool allows you to store, organize, and retrieve policy documents efficiently. It helps reduce downtime in business operations.

- Business process management (BPM) software. Similar to policy administration systems, this tool can automate tasks and provide insight into processes and their areas for improvement.

3. Insurance Underwriting

Verifying a policyholder’s age, health, driving history, credit score, and coverage time is tedious due to its time-consuming and repetitive nature. However, insurance firms must protect against losses.

BPO offers expert insurance teams that can help reduce errors in processes and services. They share some, if not all, of the workload, including:

- Application materials review

- Risk profile evaluation

- Underwriting recommendations

- New business underwriting

- Renewal underwriting

- Risk assessment and pricing

Some of the tools these professionals use for business process improvement include:

- Underwriting and rating software. These tools automate data entry, risk assessment, and pricing for BPO teams. The top underwriting and rating software and tools are PL Rating, Applied Epic, and OPUS.

- Data mining and analytics tools. These tools identify risky data patterns and trends to improve underwriting decisions and help develop new products and services.

- AI and ML. As mentioned, utilizing AI and BPO is a popular combo. ML is a subset of AI and can be used to digitize applicant risk assessments and detect fraud.

- Cloud computing. This technology allows teams to access and manage underwriting software and data anywhere with an Internet connection and in real time.

4. Customer Service

Customer service is among the most common BPO roles and responsibilities outsourced by various businesses. Outsourcing companies offer call center support to help your insurance firm promptly respond to questions and concerns.

Insurance BPO customer service agents are trained to:

- Answer phone calls and emails from policyholders and stakeholders

- Provide information about insurance products and services

- Process claims

- Resolve customer issues

- Educate customers about their coverage and its proper use

- Upsell and cross-sell insurance products and services

- Maintain customer records

- Track customer interactions

Outsourcing providers leverage the following tools to streamline customer support tasks:

- Knowledge management system. This tool allows customer service agents easy access to insurance products and services, company policies and procedures, and frequently asked questions (FAQs) pages.

- Customer relationship management (CRM) software: You can use this to track customer interactions, manage data, and provide personalized services.

- Chatbots: Your insurance firm can rely on chatbots to address FAQs and resolve common issues without human CSRs.

Top Reasons Why You Should Outsource Insurance Processes

A better understanding of benefits and services allows you to easily outline what BPO is used for, especially in the insurance industry. Here are the top use cases for outsourced insurance processes:

- Streamline operations. Outsourcing helps enhance operational efficiency. The cutting-edge technologies, scalable expertise, and various services it provides allow you to accomplish more tasks in less time and improve service quality.

- Increase profitability. Lower costs lead to reduced premiums for policyholders, which could result in higher profits for your insurance firm. Additionally, with outsourcing, you typically never spend more than you earn. Conducting a cost-benefit analysis helps you better weigh cost reductions.

- Enhance security and compliance. Technological solutions offered by BPO providers help reduce the risk of data breaches and other security threats. Tools such as BPM software can help your firm monitor compliance in your operations by providing a framework for various processes.

- Improve customer satisfaction. All the BPO benefits and services in insurance help improve policyholders’ journeys. From pre-sale to purchasing to providing support and upgrades, you can guarantee a positive customer experience for your clients.

The Bottom Line

Outsourcing in the insurance industry presents great potential for improving various complex processes. The sector’s future will likely involve more extensive collaboration with BPO providers as insurers seek to stay ahead in the rapidly evolving landscape.

Are you considering outsourcing some of your processes? Let’s connect and start with small BPO projects for your insurance company. Unity Communications has extensive experience in claims processing and customer service. From there, we can scale other operations to meet your customers’ needs.