Table of Contents

Learn more about outsourcing services for Phoenix businesses. Watch the video below.

Dallas’s robust economy drives businesses to constantly seek strategies to attain long-term returns on investment (ROI). Business process outsourcing (BPO) is an increasingly popular approach to achieving such goals. This strategy cost-effectively fills financial roles by outsourcing third-party talent in Dallas, TX, and similar hubs.

This article delves into the benefits of outsourcing financial roles. It also details how each advantage can help your business increase profitability and cost savings. Read until the end to find tips for partnering with a BPO provider in Dallas, TX, and identifying services you can delegate.

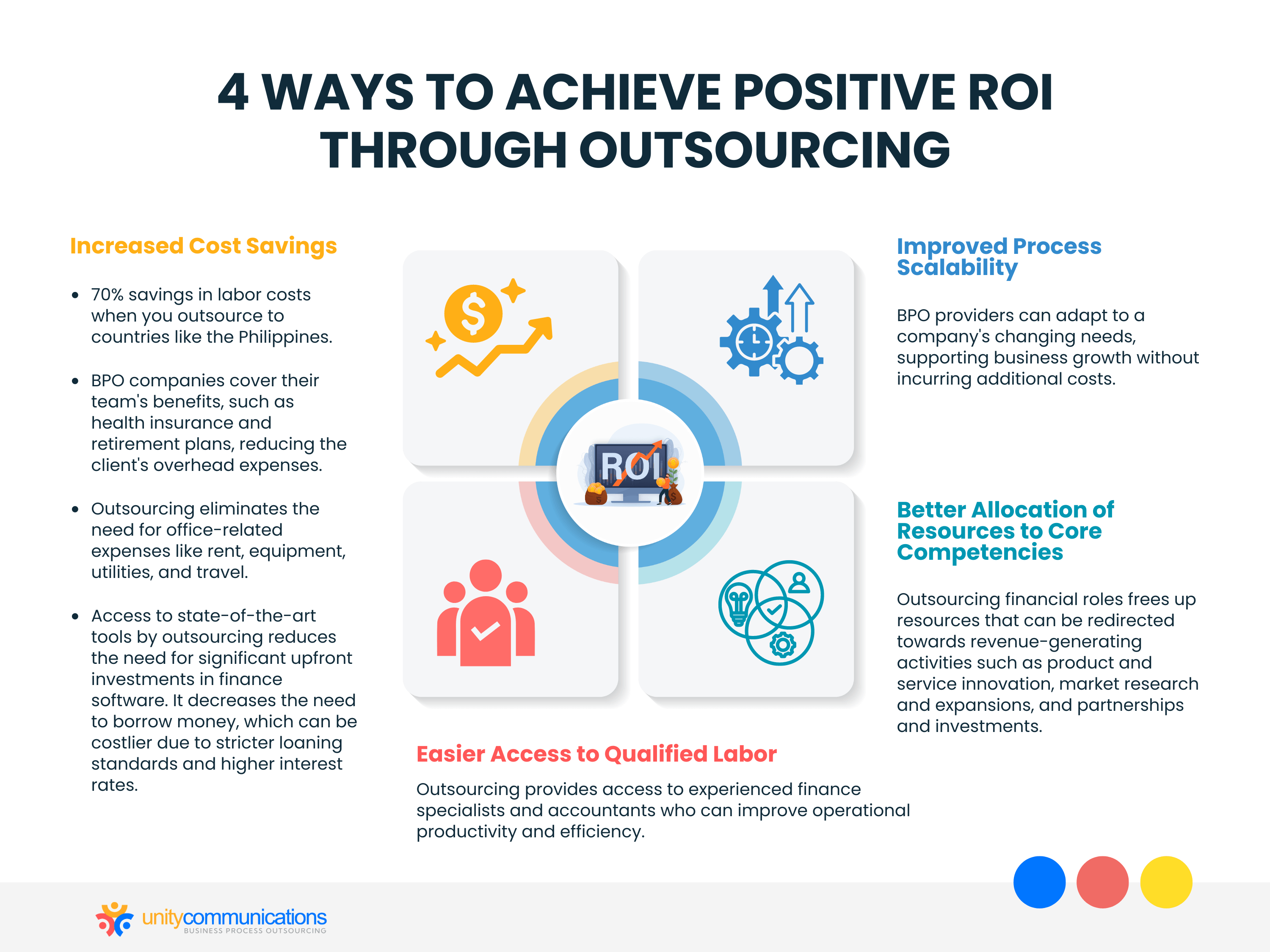

Four Ways You Can Achieve Positive ROI Through Outsourcing

Financial roles and processes can be time-consuming and repetitive, so outsourcing has become popular among businesses in Dallas, TX. It enables companies to benefit from economies of scale by streamlining financial processes and increasing profitability while reducing costs.

But what is BPO? How does it help companies achieve long-term ROI?

This strategy involves subcontracting an external provider for tedious non-core functions, such as financial roles. Outsourcing can help you achieve long-term positive ROI by increasing cost savings, enabling scalability, accessing qualified labor, and focusing on central functions. Let us discuss each benefit in detail.

Increased Cost Savings

Achieving long-term positive ROI starts with reducing operating costs, which is why finance and accounting outsourcing is the perfect solution. Partnering with a financial BPO company is less expensive than hiring an in-house team. Here are ways outsourcing helps your business increase cost savings:

- Lower labor costs. Dallas has high living expenses and compensation rates due to its emergence as a major economic and business hub. Outsourcing to countries with lower wage ranges can significantly reduce labor costs. Reports say companies save 70%–90% in wage payouts when outsourcing to the Philippines.

- Reduced expectations on benefits. Local workers have a growing demand for better compensation packages. With several corporate giants in the city, keeping offers competitive can be costly. BPO companies cover their team’s benefits, such as health insurance and retirement plans, so you do not have to worry about these expenses.

- Decreased overhead expenses. BPO teams can fulfill financial roles during an outsourcing engagement. They provide your business in Dallas, TX, with remote workers. You no longer have to allocate a budget for office rent, equipment, utilities, and travel. Providers also handle hiring, onboarding, and training processes, saving costs.

- Fewer infrastructure investments. Outsourcing firms leverage state-of-the-art tools, allowing you access to the latest finance software. This access helps you avoid significant upfront investments. It also reduces your need to borrow from banks, as the inflation in Dallas calls for stricter loaning standards that incur higher interest rates.

When you save money on costs, you can improve your market position by offering your products and services at lower rates. This strategy gives you a competitive advantage in the fierce commercial landscape and helps you achieve positive ROI in the long run.

Easier Access to Qualified Labor

Dallas has a tight labor market with a low unemployment rate and a high 3.8% job growth rate. According to the Dallas Morning News, the metro area recently opened 20,000 finance jobs. Due to these conditions, businesses find it challenging to fill financial roles locally, so many have turned to outsourcing in Dallas, TX.

Fortunately, one of the most well-known finance outsourcing benefits is better access to expertise. BPO providers employ experienced finance specialists and accountants. These professionals are skilled and proficient in various fiscal functions, helping improve operational productivity and efficiency.

Outsourcing teams are also knowledgeable about the latest risk management best practices. They can help you develop mitigation strategies, such as hedging, diversification, and contingency planning.

Additionally, they are well-versed in the different financial regulations that Dallas businesses comply with, such as:

- The Securities and Exchange Commission’s (SEC) regulations

- The Commodity Futures Trading Commission’s (CFTC) regulations

- The Financial Industry Regulatory Authority’s (FINRA) regulations

- The Texas Securities Act

- The Texas Department of Banking (TDB)

Compliance with these laws reduces the risk of costly penalties and reputational damage. Thus, access to qualified labor at lower costs increases profitability and generates excellent returns from your outsourcing investment.

Improved Process Scalability

BPO providers can meet your company’s changing needs as it grows. Whether you need to fill financial roles due to high-volume transactions or a changing commercial environment, outsourcing teams can support your Dallas, TX, business.

Thanks to readily available resources, third-party providers allow your company to grow without incurring additional costs. They have the technologies to meet increased demands without sacrificing efficiency. These innovations include:

- Accounting software. Accounts payable, accounts receivable, and general ledger accounting are tedious tasks. Leveraging accounting software helps automate and streamline such functions. Popular programs include QuickBooks, Xero, and NetSuite.

- Financial planning and analysis (FP&A) software. Your business can use this tool to create and track budgets, forecasts, and financial plans. Anaplan, Adaptive Insights, and Workday Adaptive Planning are some common FP&A programs.

- Robotic process automation (RPA) tools. You can automate repetitive tasks, such as data entry, invoice processing, and payroll processing, through RPA software. Specialists commonly use UiPath, Automation Anywhere, and Blue Prism as their tools.

Such scalability and flexibility also apply to low-volume days. You need not worry about overstaffing financial roles when outsourcing your Dallas, TX, business functions. It also means fewer rehiring challenges when demands pick up again. Many industries are facing this challenge due to uncertainties in employment availability.

In addition, a scalable business is more attractive to investors and acquirers due to its potential to generate significant revenue and profits efficiently. With proper financial planning and forecasting through an expert team, scalability gives your business a higher valuation and exit multiples.

These factors can enhance your reputation and make it easier for your business to raise capital and attract partners and customers. The higher your valuation and exit multiples, the higher the ROI.

Better Allocation of Resources to Core Competencies

All the benefits mentioned above allow you to refocus your budget, time, and energy on other areas that generate revenue and returns. You can focus on impactful initiatives that align with your business and financial goals, including:

- Product and service innovation. Generate profits by continuously improving your existing products and services or developing new ones. This practice helps enhance consumer satisfaction and retention.

- Market research and expansions. Stay updated with industry trends and assess your target audience’s pain points. Analyzing your market helps you create profitable solutions and reach new trades for long-term ROI.

- Partnerships and investments. Joint ventures, co-marketing agreements, referral programs, and mergers and acquisitions (M&A) can help your business increase brand awareness. A strong presence attracts and retains customers and investors.

Financial Roles Typically Outsourced by Businesses in Dallas, TX

BPO providers can handle both customer-facing and internal support financial operations, including:

- Accounts payable and receivable (AP/AR). This task is vital to tracking and managing your business’s cash flow. On the one hand, AP teams process invoices from suppliers, reconcile accounts, and manage vendor relationships. On the other hand, AR teams send invoices to customers, issue credit notes, and manage customer relationships.

- Bookkeeping. Finance BPO teams have the necessary tools to efficiently and accurately record your business’s financial transactions. Such activities include sales, purchases, expenses, and payments. They then use this information to create financial statements, such as balance sheets and income statements.

- Data entry and processing. Entering data into systems and analyzing it to extract meaningful insight can be daunting. Outsourcing data entry and processing allows you to automate these tasks, reducing the risk of errors. BPO providers can also employ data conversion specialists and miners.

- Payroll processing. Outsourced payroll processes cover data collection, wage calculation, tax deduction, payroll reporting, and paycheck issuance. Partnering with a BPO provider for these tasks can help your business avoid incidents such as the Dallas County payroll crisis.

- Tax preparation. Collecting tax information, filing tax returns, and providing tax advice require accuracy and timeliness to avoid violations and penalties. Outsourcing teams have the expertise and tools to navigate the complexities of tax codes, returns, and audits, helping you ensure compliance.

- Customer support and system help desk. Partnering with a BPO company offers round-the-clock support teams for your clients and internal team. Access to support agents beyond regular working hours increases customer satisfaction and operational productivity.

Maximizing Financial Roles: Outsourcing Tips for Your Business in Dallas, TX

Overall, outsourcing can help your business generate a high ROI. However, partnering with a provider is not a short process; BPO long-term planning is critical. Consider the following steps to optimize outsourcing for a positive ROI:

- Assess your goals and needs. Identifying your objectives is essential to ensuring the success of your outsourcing initiative and guaranteeing ROI. Set specific and achievable goals by analyzing your financial processes and determining what you want to outsource and why. Determine what you expect to achieve by partnering with a BPO provider.

- Research potential partners. List down outsourcing companies that would best meet your goals and needs. Read about their services, rates, track record, and commitments to better understand what it is like to partner with them. Compare these factors to ensure you choose the right provider and get your money’s worth.

- Set clear service-level agreements (SLAs). Once you have decided on a BPO partner, draft a contract. Specify performance metrics, such as uptime, availability, response time, resolution time, and accuracy. Defining requirements ensures your BPO partner meets your expectations. SLAs also help manage and improve performance quality.

- Develop a transition plan. Employing BPO teams changes your business’s systems and management significantly. Avoid issues such as disruption, data loss, security breaches, etc., by implementing a solid transition plan. Specify your points of contact (POCs), collaboration strategies, communication strategies, and timelines.

- Monitor and manage BPO teams. Regularly track and provide feedback on your outsourcing team’s performance. This step helps address any issues and areas for improvement early on. It also identifies which processes the third-party team excels in so you can make necessary adjustments to your plan and maximize ROI.

- Conduct a cost-benefit analysis. Measure your ROI occasionally to ensure your outsourcing initiative is still cost-efficient. Perform a cost-benefit analysis by reviewing your goals and expectations and calculating in-house versus BPO costs. Analyze potential financial and non-financial benefits to see if they outweigh your expenses.

The Bottom Line

As businesses strive for financial success, BPO becomes a popular strategy. Financial roles are vital to business operations, and outsourcing them offers many benefits for companies in Dallas, TX.

This practice is a cost-efficient solution for the city’s dynamic economic and corporate landscape. It increases cost savings, allowing companies to benefit from economies of scale.

Let’s connect if you want to increase your business’s ROI through outsourcing. Unity Communications is committed to helping you enhance market penetration and capitalize on revenues.