Table of Contents

Learn more about outsourcing services for Phoenix businesses. Watch the video below.

In Dallas’s dynamic and competitive economic landscape, achieving sustainable growth can be challenging. The city’s rising inflation rates make balancing business profits and costs difficult.

Thus, many companies rely on finance business process outsourcing (BPO). This strategy involves hiring a BPO provider in Dallas, TX, to reduce expenses and access financial experts. It helps companies increase profitability without incurring additional costs.

If that interests you, then continue reading. This article explores how Dallas businesses can optimize the benefits of finance BPO to achieve sustainable growth. It also discusses valuable outsourcing tips you can adopt for a successful venture.

Sustainable Growth and Its Importance for Dallas Businesses

Sustainable growth is a business’s realistic ability to increase its operations over time without increasing financial leverage. It promotes economic expansion, improved competitiveness, and long-term stability. Scaling sustainably means not growing your business too quickly that it decreases profitability or too slowly that it cannot keep up with the competition.

Look at the city’s corporate and economic landscape to better understand the importance of sustainable growth for local businesses. Dallas is a major healthcare, technology, and finance business hub. It is home to over 65,000 enterprises and several Fortune 500 companies, such as AT&T, Southwest Airlines, and AECOM.

The city’s status attracts more enterprises and residents daily, increasing the demand for goods and services. Thus, vendors and suppliers mark up their rates. This inflation leads to an increasing cost of living in Dallas, which is 3% higher than the national average. It also impacts workers’ standards for compensation, leading them to demand higher salaries and better benefits.

The Dallas labor market also has robust job growth and low unemployment rates. To attract more talent, companies offer more competitive wages. These conditions lead to higher compensation costs, which can decrease business profitability.

The city’s fierce economic landscape and tight labor market make it challenging for businesses to survive. Data from the Bureau of Labor Statistics (BLS) show that only 25% of companies make it beyond 15 years.

Sustainable growth promotes continuity in the local economic climate. However, inflation can undermine this strategy. Thus, many Dallas businesses rely on financial BPO providers and practice outsourcing for sustainable growth. They follow the tips and best practices below.

Maximizing Dallas Business Growth: Finance BPO Outsourcing Tips

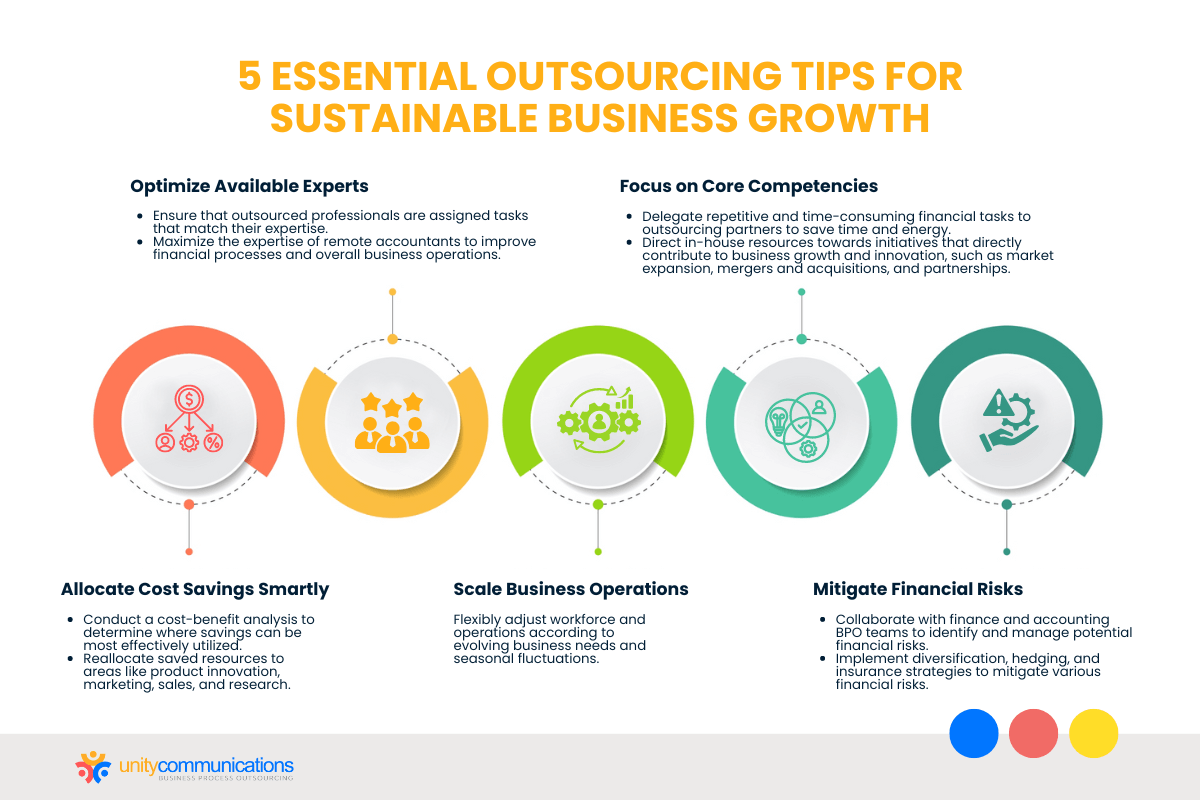

Your business can utilize finance and accounting outsourcing to sustain growth. This strategy involves reallocating resources and optimizing leveraged expertise. It also includes scaling operations, focusing on core competencies, and enhancing risk mitigation measures.

Before we discuss these tips in detail, it is essential to answer the question: What is BPO? Specifically, what is finance BPO?

It is the business practice of subcontracting time-consuming and repetitive accounting functions to third-party providers or virtual assistants. Finance outsourcing benefits include reduced costs, streamlined processes, improved productivity, and increased cost-efficiency.

In itself, outsourcing already promotes sustainable business growth. Follow these best practices to ensure you make the most of its benefits.

1. Allocate Cost Savings Smartly

Outsourcing helps you significantly reduce overall expenses, which is the first step toward sustainable growth. Here are the common areas you can save on through finance and accounting BPO:

- Compensation costs. Outsourcing can help you save up to 70% on labor costs. This significant reduction is due to a difference in cost of living and wage ranges. BPO firms also handle their employees’s compensation packages, including health insurance and retirement plans. Offering attractive benefits can be costly due to the tight labor market.

- Hiring costs. Recruiting talent can be expensive. The price per hire ranges from 0.5 to two times more than your offered salary. It is an investment that runs the risk of employing short-term or bad hires. Most outsourcing companies manage hiring processes, including screening, interviewing, onboarding, and training workers.

- Overhead costs. Outsourcing cost savings go beyond labor costs. Teaming up with virtual assistants means you do not have to allocate a budget for office rent, utilities, and supplies. BPO firms also leverage advanced accounting automation software and finance tools, so you can avoid making significant, upfront investments in such technologies.

Your Dallas business can save and reallocate resources to more central areas by partnering with a finance BPO firm. Another practical outsourcing tip is to conduct a cost-benefit analysis to determine which business aspects increase your profitability the most. Consider the following operations:

- Product innovation. Improve existing products or develop new ones to enhance consumer satisfaction and retention. Continuous innovation is essential to staying ahead of the competition and market.

- Marketing and sales. Increase sales by reaching new customers. Investing in marketing and sales helps scale your business and improve its financial health.

- Research and analysis. Invest in market research and analysis tools to better understand your target’s needs. Assessing trends and determining pain points help you create more profitable solutions.

2. Optimize Available Experts

BPO providers allow you to tap into a global pool of financial specialists and accountants at a lower cost. It is one of the most popular advantages of back-office offshoring services. Better access to qualified and economical talent benefits businesses in Dallas, considering its tight labor market and surging compensation costs.

Outsourcing companies screen their teams to ensure they have sufficient educational and professional backgrounds in finance and accounting. Third-party professionals are well-versed and trained in different fiscal functions, such as:

- Bookkeeping

- Account management

- Ledger management

- Audit reporting

- Budget preparation

- Tax preparation

- Payroll processes

- Year-end account processes

- International Financial Reporting Standards (IFRS) services

Saving on labor costs while increasing profitability through leveraged expertise is already a significant step toward sustainable growth. Dallas businesses that partner with finance BPO providers can benefit from this outsourcing tip. However, you can further this opportunity by maximizing their expertise.

Be sure you do not waste remote accountants’ talent by putting them in roles for which they are overqualified. Assigning them tasks that put their knowledge and skills into practice is critical to improving financial processes and overall business operations.

3. Scale Business Operations

Your financial needs evolve as your business grows, and you may experience seasonal volume fluctuations. Outsourcing lets you scale your workforce and operations as needed. This flexibility helps ensure your financial support aligns with your company’s growth trajectory.

For example, you can add extra staff during busy seasons, such as the first quarter of the year, without spending too much on hiring processes. Meanwhile, you can dismiss accountants when the workload is low, helping you prevent overstaffing. In-house hiring or labor recalling can be challenging in the fierce Dallas labor market.

Customizing your workforce size means you can spend less on labor and services your business needs. Thus, scalability is an essential part of sustainable growth. Feel free to scale your operations when necessary.

4. Focus on Core Competencies

Aside from improving efficiency and cost savings, outsourcing lets you channel your time and energy to more central business endeavors. Dallas businesses partner with finance BPO providers to enjoy this outsourcing benefit and tip the scales in their favor.

With repetitive and time-consuming financial tasks off your plate, you can focus on initiatives directly contributing to your business’s growth and innovation. Here are a few core competencies your company can dedicate in-house resources to:

- Market expansion. Increasing your customer base and sales is crucial for sustainable growth. Develop plans to expand into new geographical areas, offer new products and services, and target new market segments.

- Mergers and acquisitions (M&A). You can increase your business’s market power and reduce competition through M&A. This business transaction allows you to combine with an existing company or purchase and absorb its operations.

- Partnerships. Working with other businesses can help your company expand its reach and capabilities. Partnerships involve joint ventures, co-marketing agreements, and referral programs.

Make the most of the extra time you get from outsourcing financial tasks to develop successful business plans. This step can help you achieve sustainable growth, stay competitive, and build a strong reputation in the dynamic Dallas business landscape.

5. Mitigate Financial Risks

Finance and accounting BPO teams can help you identify, address, and manage potential financial risks, such as:

- Credit risk

- Market risk

- Operational risk

- Liquidity risk

- Regulatory risk

BPO teams can provide valuable insights and strategic fiscal advice to help you make better financial decisions for your business. Here are a few mitigation strategies:

- Diversification. Invest in various assets to reduce the risk of losses if one of your investments performs poorly.

- Hedging. Utilize financial instruments to offset the risk of losses from financial assets or investments.

- Insurance. Purchase insurance to protect against financial risks, such as credit risk, property damage, and liability.

Collaborate with your remote accountants to develop unique and custom risk mitigation strategies. Combining your knowledge of Dallas businesses with a finance BPO team’s technical mastery and skills is an outsourcing tip you should consider.

Working with a trustworthy BPO provider helps your business avoid unexpected costs that disrupt cash flow, which is vital to measuring sustainable growth.

The Bottom Line

Outsourcing finance and accounting tasks is a strategic move for companies in Dallas to achieve sustainable growth and business expansion.

It helps them reduce costs, access expertise, focus on core activities, improve risk mitigation, and increase workforce scalability. Businesses can increase profitability while reducing costs by strategically reallocating resources and maximizing the talent of BPO teams.

Let’s connect if you are searching for a reliable finance BPO partner. Unity Communications focuses on enhancing market penetration to help businesses in Dallas achieve sustainable growth.