IN THIS ARTICLE

Written by Joyce Ann Danieles

Contents

Business of all kinds takes place in a regulatory-heavy environment in almost all countries. Companies may be sanctioned by regulatory bodies for failing to comply with corporate- and government-level regulations. No company can afford to disregard regulatory tenets, no matter how insignificant-seeming it may be.

Compliance establishes the foundation for building your company’s reputation in the business process outsourcing (BPO) market. It takes time to gain loyal customers, partners, and investors locally and internationally. Therefore, you need to abide by laws to protect your BPO enterprise.

Learn through this article about the significance of business process outsourcing compliance. You will also discover how to conduct compliance audits in outsourcing.

Understanding Compliance in BPO

Compliance refers to adhering to policies, standards, and procedures set by your company, industry, or the government. The approach covers both in-house rules and state and federal laws, as well as published industry standards.

When you engage in business process outsourcing, implementing a compliance technique helps your company identify and prevent violations of rules. You can create a dedicated program to monitor your compliance policies consistently and accurately over time. The initiative can guide you in protecting your organization’s reputation and avoiding lawsuits and fines.

An effective compliance program enhances communications between leadership and staff and educates both about existing and new compliance policies. It should also involve a process for developing, updating, enforcing, and tracking compliance policies. After all, your employees adhere to rules and regulations they do not know exist–but your company can be penalized by regulatory authorities anyway.

Moreover, expect that your teams can prioritize achieving organizational goals and help streamline operations when they fully comprehend corporate-level and government-level compliance policies. You can also see more employees reporting illegal or unethical activities if they are properly briefed and trained on satisfying compliance requirements.

To further understand what business process outsourcing compliance is and its importance, analyze how highly regulated business sectors–healthcare, call center, and finance–follow set rules and regulations.

Compliance in Healthcare Support Outsourcing

Following all legal, professional, and ethical standards in the medical field refers to healthcare business process outsourcing compliance. A BPO company specializing in this field must ensure proper compliance because the stakes are high. Even minimal mistakes can severely impact patient outcomes, care coordination, and patient safety.

To become a compliant healthcare BPO provider, you must draft a healthcare compliance plan containing policies, procedures, and ethical standards in the medical field. You should focus your plan on addressing risk areas such as billing, claims to process, and electronic health records storage and analysis.

You can ensure ongoing auditing and monitoring of this plan using healthcare compliance software. The platform can assist you in assessing and communicating enterprise-wide risks in real time.

If you violate critical laws and policies surrounding healthcare, you may face lawsuits, fines, or recoupments. Non-compliance might also affect your reputation and ability to contract with companies. They might not trust you in handling their patient data entry, medical billing, claims processing, and other healthcare support services if they learn your company has breached regulations.

Compliance in Call Center Outsourcing

Business process outsourcing compliance in call centers involves abiding by laws that help secure sensitive data shared and captured during daily customer interactions. Specific policies for call center operations vary for different countries, but they primarily tackle security aspects like data theft and proper information management.

Below are the three common compliance practices that your call center managers should know.

- Keep customer data safe. Establish a system to safeguard the sensitive personal information that customers provide during a call. You have to restrict access to such data to authorized personnel only. You must also monitor all your agents with access to confidential data.

- Control outbound calls. Categorize landline and mobile device contacts for your sales and telemarketing projects because they are regulated under different laws. Set appropriate schedules for outbound calls and provide customers with an option to opt out of any telemarketing communications. Record every outbound call to prove compliance in case of disputes.

- Secure call recording consent. Always ask customers beforehand for permission to record a call. You must also get written consent from your agents to do telephonic conversation recording. This practice helps strengthen privacy protection and enhances your company’s image.

To improve your compliance with call center rules and regulations, you can train your frontline agents by regularly providing refreshers about proper customer data gathering, handling, and processing. As part of your growing business strategy, you can also use advanced technology solutions to meet compliance requirements.

Most importantly, develop your formal in-house compliance policy detailing clearly defined rules, procedures, and accountabilities. Include a general safety checklist in your policy to help reduce casual compliance-related negligence among your staff. Also, highlight the severity of common mistakes to raise awareness among your agents.

Compliance in Finance Outsourcing

Most hackers and malicious actors target financial institutions to gain monetary proceeds. According to Verizon’s 2023 Data Breach Investigations Report, 83% of recorded data breaches were driven by financial gain. As a result, companies in the financial services industries, including those that outsource to BPO providers, closely follow compliance requirements to safeguard their clients.

Compliance in outsourcing finances means obeying federal and state laws to help strengthen the stability and integrity of your financial support system. However, ensuring BPO compliance in the financial sector starts by developing solid policies and procedures to prevent threats in the future.

You can designate a corporate compliance officer to lead efforts for guiding strict adherence to financial rules, minimizing liability risks, and implementing industry best practices. The official must be dedicated to handling critical compliance responsibilities, especially when responding to cyberattacks.

Moreover, you can deploy systematized tools to assist your CCO in monitoring your compliance efforts effectively and continuously. According to Refinitiv’s Global Risk and Compliance Report 2021, 86% of surveyed companies confirmed that innovative digital technologies have helped detect financial crimes. Therefore, you should adopt critical systems to help ease your compliance work.

Setting up your culture of accountability and compliance while providing financial BPO services urges your employees to be more productive and contribute to broader company goals. Compliance also enables building trust between team members at all levels of your business.

Performing Compliance Audits in BPO

To achieve positive business process outsourcing results, you need to adhere to in-house and federal policies to protect your company from various threats. Conducting compliance audits can serve as your first line of defense in preventing violations and sanctions.

A compliance audit refers to a formal and comprehensive review of your daily operations to ensure you are meeting all applicable rules and regulations. It details the strength of your compliance preparations, risk management procedures, security policies, and user access controls.

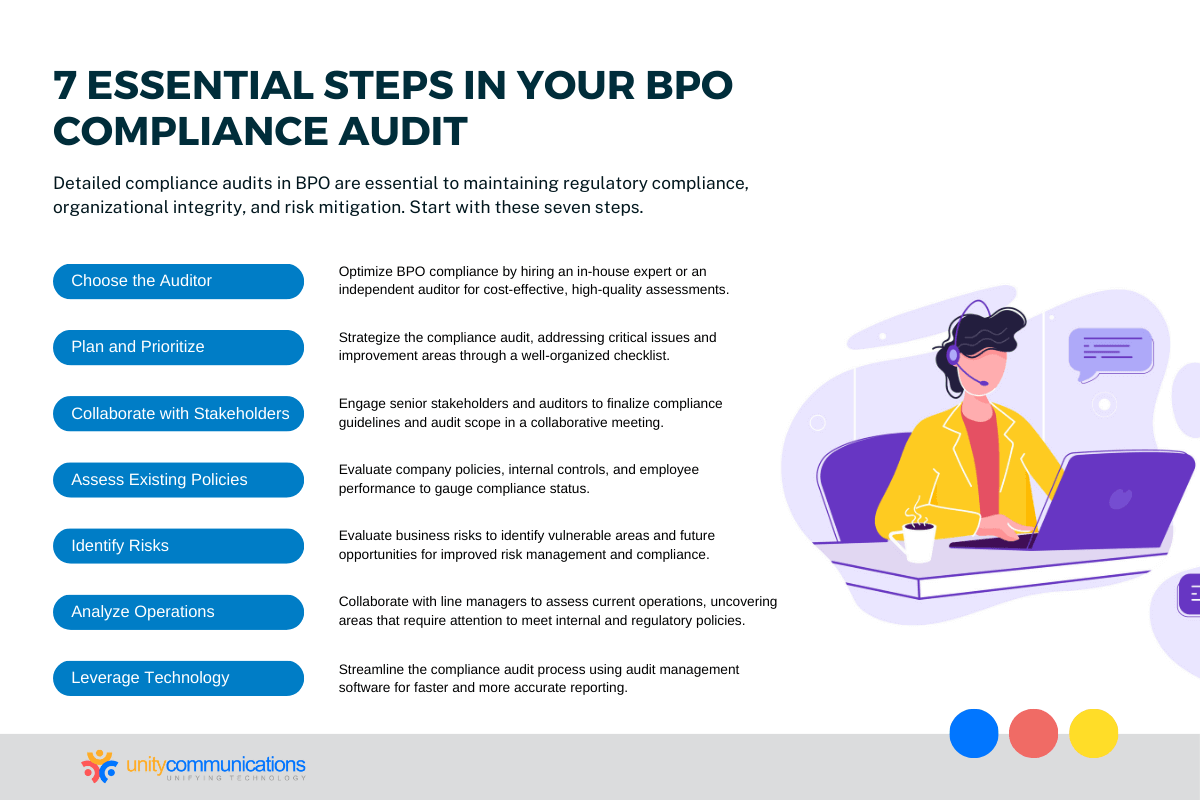

You can include these seven steps in your BPO learning center to perform proper compliance audits.

1. Select Compliance Auditor

Your first step to BPO compliance is to choose who will perform the audit. You may assign someone from your in-house team, such as your compliance officer. You can also hire an independent auditor to save costs while ensuring high-quality compliance auditing.

2. Brainstorm

Plan the method you will take throughout the compliance audit. Identify critical issues that need resolutions and areas that need improvements. Have a checklist of these important matters as much as possible.

3. Meet With Key Stakeholders

Once a strategic plan of action is in place, set a meeting between your senior stakeholders and auditors to begin the compliance review process. Both parties will exchange ideas to finalize compliance checklists and guidelines. This step also involves determining the scope of the compliance audit.

4. Evaluate Existing Processes

The compliance auditor will assess the effectiveness of your company’s existing management policies. The official will also review employee performance, internal controls, and related documents. These factors are necessary to identify the status of your compliance with rules and regulations.

5. Assess Risks

The compliance auditor must also evaluate your company’s risks in changing business and economic conditions. This step identifies your company’s vulnerable areas, concerns, and future opportunities. The officer provides assurance, advice, and feedback on risk management and compliance.

6. Analyze Operations

The auditor will coordinate with line managers to review your current business operations. The officer will then report their findings on the positive and negative sides of your processes. You will also know which areas of your operations need to be addressed due to non-compliance with internal policies or state and federal rules.

7. Consider Technology Access

You can use audit management software to help your compliance auditor streamline its work. Enable the officer to use such advanced tools to schedule the audits and properly analyze the results. You can expect more accurate compliance reporting results rapidly.

After accomplishing these steps correctly, you can receive many advantages relating to your business process outsourcing compliance. These benefits may include:

- Ensuring workplace safety

- Monitoring compliance status

- Managing risks efficiently

- Verifying data security-related processes

Reaching this part of the article means you have learned the importance of compliance in your business process outsourcing company. You just have to ensure that the mentioned practices are included in your BPO long-term planning strategies for continued compliance and success.

The Bottom Line

BPO companies must follow regulations to maintain a good reputation, streamline operations, and strengthen information security. Compliance is important in finance, healthcare, and call center industries for business process outsourcing.

To prevent the high costs of violations, sanctions, and penalties, you should perform regular compliance audits. This approach allows you to identify the areas of your business vulnerable to non-compliance to laws and, thereby, need improvements.

After knowing the value of business process outsourcing compliance, check out Unity Communications’s website to know how to abide by the BPO industry’s policies and procedures appropriately.