Table of Contents

Many international and foreign companies in different industries hire offshoring providers in the Philippines for their accounting processes. This Southeast Asian country is one of the globe’s leading outsourcing hubs.

When you outsource accounting services, you assign bookkeeping, financial data recording, auditing, and tax compliance tasks to accounting professionals overseas.

Do you want to know what makes the Philippines a favorite destination for outsourced accounting services? Keep reading!

16 Advantages of Outsourcing Accounting Services to the Philippines

Discover why the Philippines is a top choice for outsourced accounting services.

1. Efficient Remote Teams for Higher Productivity

Companies can outsource data entry services, digital marketing, help desks, and customer support to remote teams in the Philippines.

When outsourcing accounting tasks to the Philippines, your third-party team probably adopts a work-from-home (WFH) or hybrid work arrangement with a flexible shift option. Remote work saves team members from doing necessary but tedious tasks such as commuting and allotting extra time for pre-work preparations.

Since the teams from accounting outsourcing companies in the Philippines rarely need to visit the office to work, they can attend to client requests and needs faster than on-site workers. The third-party team also uses private and secure applications for remote work.

WFH contractors are productive due to the following factors:

- High-end data security. Third-party workers use virtual private networks (VPNs) and the latest antivirus software to protect critical client data from breaches and intrusions. They regularly change passwords and use exclusive verification methods.

- Frequent use of collaboration apps. A third-party accounting team relies on communication software for simultaneous and seamless interaction. They commonly use Zoom, Slack, Skype, and Microsoft Teams.

- Regular online meetings. Managers coordinate frequent video or audio calls to monitor the third-party teams’ progress and concerns.

- Organized remote work. A service provider enforces straightforward WFH policies for better collaboration, workflow, and conduct.

- Well-equipped WFH staff. Business process outsourcing (BPO) companies equip remote workers with the latest computer systems (hardware and software) and devices to let them quickly and accurately complete their tasks.

2. Consistent, Transparent Accounting Standards for Global Compliance

Philippine accounting procedures are compatible with the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB), an independent accounting and financing body in London.

Organizations in more than 120 countries base their financial reporting processes on IFRS. In the Philippines, the generally accepted accounting principles (GAAP) are the Philippine Accounting Standards (PAS) and the Philippine Financial Reporting Standards (PFRS). Both standards currently use IFRS as a reference.

GAAP varies from country to country because of the different legal, economic, and cultural setups. Despite a slight difference in accounting standards, Filipino accounting professionals are well-known for their flexibility. They can familiarize themselves with industry principles and government regulations in no time.

Filipino certified public accountants (CPAs) can easily manage accounting standards, measures, or procedures. Their world-class skills are the reason international accounting firms, such as Klynveld Peat Marwick Goerdeler (KPMG), Ernst & Young, PricewaterhouseCoopers (PwC), and Deloitte, established operations in this nation.

3. Cost-effective Solutions Due to Lower Compensation Costs

The Philippines has one of the lowest salaries among the different outsourcing destinations. As such, Philippine service providers can offer their clients affordable rates for outsourced accounting processes.

Here are the average monthly salaries of outsourced accounting professionals in the Philippines compared to the UK and the U.S. (in U.S. dollars):

| Position | Philippines | UK | U.S. |

|---|---|---|---|

| Accountant | $501 – $1,001 | $2,872 – $4,765 | $4,373 – $7,291 |

| Accounting assistant | $437 – $956 | $2,713 – $3,260 | $2,781 – $4,382 |

| Accounting manager | $728 – $1,183 | $4,515 – $7,273 | $6,250 – $10,502 |

| Auditor | $537 – $1,001 | $3,512 – $5,016. | $2,600 – $7,701 |

| Bookkeeper | $546 – $1,047 | $4,696 – $6,522* | $3,088 – $4,875 |

| Financial analyst | $590 – $1,092 | $3,935 – $6,771 | $5,208 – $8,741 |

Source: Talent.com

(Note: We converted the Philippine and UK salary figures to U.S. dollars for uniformity using an exchange rate of PHP 54.94 per $1 and 1£ per $1.20 as of February 21, 2023. We also converted all figures from yearly to monthly.)

Based on the table above, the average salary of a Filipino bookkeeper is about $546 per month ($6,552 per year). In the U.S., a bookkeeper’s monthly salary is $3,088, or roughly $37,056 annually. You can save $30,504 ($37,056 less $6,552) per worker annually when outsourcing accounting services to the Philippines.

The examples and salary information above are estimates. Contact a service provider to get the exact figures.

4. Reduced Legal and Management Duties for Minimal Financial Risk

Like the U.S., the workforce in the Philippines can legally form labor or trade unions for bargaining power. By outsourcing accounting services to the Philippines, companies can avoid the legal and financial risks of directly hiring local talent.

When companies outsource tech solutions or accounting and bookkeeping processes, the service provider oversees recruitment activities, from advertising vacancies to onboarding new hires. It also monitors staff income taxes, attendance, and similar duties. Client companies only need to check the provider’s periodic reports.

Allowing third-party providers to handle human resource (HR) activities provides the following benefits:

- Uncomplicated operations. A service provider has HR experts to ensure the third-party team’s compliance with government regulations and industry standards.

- Broad talent reserve. A BPO company has an extensive recruitment process to provide clients with candidates that best fit accounting roles.

- Cost-effective services. If a business needs extra staff, it will not have to pay additional expenses for taxes, non-monetary benefits, and compensation costs. The service provider uses its resources, funds, and accounting team to guarantee cost efficiency.

- Freed-up time. HR activities are burdensome and tedious. Assigning these tasks to a service provider is more practical for many companies.

5. Various Outsourced Services for Different Accounting Needs

Businesses have diverse options when outsourcing accounting processes to the Philippines. The following services are available:

- Tax accounting. A business process outsourcing (BPO) company follows the tax procedures and laws of the client’s country to process tax returns and similar documents.

- Statutory compliance and reporting. A service provider helps clients organize and submit financial records to government agencies, ensuring compliance with laws and standards.

- Payroll services. A BPO provider is responsible for repetitive payroll functions. It thus frees up time and enables companies to pursue higher-value tasks.

- Management accounting. A BPO company prepares financial reports to help clients make better decisions. It evaluates and explains accounting data using operational metrics or key performance indicators (KPIs).

- Accounting audit. A service provider manages financial statements, receipts, and documents. It tracks, analyzes, and updates data to reduce the risk of fraud or malpractice.

- Forensic accounting. A third-party firm can examine a client’s finances. Forensic accountants investigate for proof of tax evasion, embezzlement, or illegal accounting tricks.

- Financial controller services. A BPO provider oversees a client’s accounting operations, guaranteeing accurate and updated cash flow information. Third-party accountants also provide advice based on financial data.

- Bookkeeping. A third-party team documents all of the client’s financial transactions. It tracks and revises records or book entries to assist the client in making operational investments and financial decisions.

- Financial analysis. A BPO company uses its client’s accounting records to evaluate sales contracts, credits and bills, and product costs. It reviews past financial performance and estimates future profitability.

6. Ideal Alternative To Meet the CPA Shortage in the U.S.

The CPA Journal states the U.S. has a serious shortage of accounting professionals. Many accountants are leaving their jobs to join the millions of American workers reassessing their careers. As such, many businesses struggle to hire qualified individuals for the positions.

The article points out that the high turnover rate and the decline in new CPAs worsened due to the decrease in accounting graduates. The COVID-19 pandemic caused a 4% decrease in college graduates acquiring a bachelor’s or master’s degree in accounting. Many baby boomer CPAs are also retiring soon.

Additionally, U.S. colleges and universities produce more accounting specialists than generalists. Many companies need general business skills that the present local workforce lacks. Generalists perform a variety of crucial financial activities, such as monitoring accounts, organizing accounting files, and processing statements and invoices.

Outsourcing accounting services to the Philippines addresses the shortage facing U.S. corporations and accounting firms. BPO companies provide businesses with professionals trained in various accounting and financial activities. Third-party accountants and bookkeepers have diverse qualifications to suit the needs of any business.

The composition of the accounting workforce in the Philippines differs from that in the U.S. The next few years will see many American CPAs retire while Filipino talent continues to flock to the accounting industry.

7. Large Supply of Accountants To Perform Outsourced Tasks

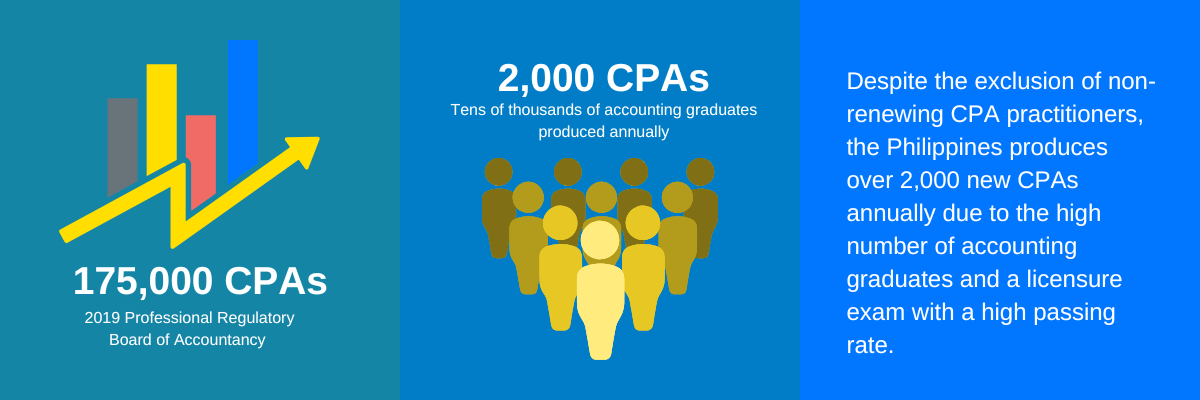

The Philippines has more than 175,000 CPAs based on the 2019 record from the Professional Regulatory Board of Accountancy, the government agency for the accountancy profession. But this figure excludes thousands of CPA practitioners who have not renewed their licenses.

Thus, 175,000+ CPAs is a low-end estimate. Philippine colleges and universities produce tens of thousands of accounting graduates annually. Some graduates fail to take or pass the CPA licensure exam conducted twice yearly. No fewer than 1,000 examinees pass the licensure exam. Given this figure, the country produces over 2,000 new CPAs per year.

Most of these graduates are also millennials (born from 1981 to 1996) and Gen Z (from 1981 to 1996). So companies hire an outsourced accounting team primarily consisting of active, motivated, enthusiastic, trainable, and technically skilled individuals.

With a steady supply of accounting professionals, Philippine service providers can guarantee skilled contractors to work on outsourced processes. Sufficient human resources also translate to consistent compensation costs.

8. Accessible New Technologies To Simplify Outsourced Functions

Back-office outsourcing lets companies access advanced technologies, platforms, and applications that can streamline processes. These sophisticated solutions help the outsourced accounting team deliver timely and accurate services.

For example, management programs track and record each team member’s productivity and performance. They also help decrease human error and manage the number of tasks.

Additionally, service providers harness cloud-based technologies to boost output and efficiency. They integrate applications into one platform for seamless workflow, taking team performance and effectiveness to a higher level.

Below are some examples of accounting and bookkeeping software:

- FreshBooks is a software application with an intuitive invoicing function. Users can generate multiple reports, input billable time and costs, customize invoice appearance, set notices for payments and late fees, and program repeating invoices.

- Plooto is an accounting program that automates accounts payable, enabling users to spend less time on manual recording. It manages payments in a single central location to better understand finances.

- Oracle Netsuite provides complete accounting and enterprise resource planning (ERP) capabilities. It lets users send and collect payments, manage taxes, and generate reports.

Service providers also invest in the following high-end technologies to find innovative ways to manage processes:

- Cybersecurity safeguards information systems against cyberattacks and online threats.

- Artificial intelligence (AI) mimics human intelligence in digital devices and machines. It is a cost-effective way of improving team productivity.

- The Internet of things (IoT) is the interconnection of physical devices. It utilizes the internet to exchange information across networks for quicker data access.

- Robotic process automation (RPA) involves software robots that do certain functions. Automated robots assist human workers with basic tasks. Live agents can thus focus on more urgent and important matters.

9. More Time and Energy for the Core Business To Improve Competitiveness

One of the perks of outsourcing accounting services to the Philippines is that companies can focus more on their core business. This strategy lets decision-makers devote more time and effort to the company’s core competencies, from market expansion and customer base improvement to product launches and service upgrades.

Delegating back-end processes, such as in accounting and technical support outsourcing, helps improve business performance, productivity, and revenue. It enables companies to pay more attention to their strong suits and be more competitive.

Achieving competitiveness leads to a higher income. With better revenue, companies can:

- Spend more on staff training and upskilling to raise morale, output, and efficiency;

- Improve or upgrade current service and product quality to attract more buyers and boost sales;

- Broaden market base sooner than expected to strengthen income stream;

- Develop and launch new products and services to give consumers more options; and

- Invest in the latest technologies or modernize existing systems to help streamline production or stay abreast of the market competition.

10. Multiple Communication Channels for Continuous Interaction

Multichannel communication lets BPO firms and their outsourced accounting clients freely interact via different channels and devices. Such provider-client communication is vital to the success of all outsourced services, even with the contact center as a service (CCaaS) solutions.

A third-party service provider can oversee the following channels to strengthen client satisfaction:

- Social media – lets users communicate on social platforms such as Instagram, Twitter, and Facebook

- Live chat – a small messaging panel on the company website

- Short message service (SMS) – short text messages sent via cellular and mobile devices for quick interaction

- Email – electronic messaging system for long written correspondence that allows sizable file attachments

- Standard phones – fixed landlines for voice calls

- Chatbots – smart software that automatically replies to simple and common questions

- Voice over Internet protocol (VoIP) telephony – used by internet-dependent users or clients with VoIP-based devices

11. Positive Work Traits for Higher Productivity and Morale

One significant advantage of outsourcing accounting services to the Philippines is that Filipino professionals have favorable work traits. Thanks to family-focused values and religious beliefs, most Filipino workers have the following qualities:

- Thorough. Filipino accountants excel at crunching numbers. They are meticulous in documenting and verifying data.

- Optimistic. Third-party workers tend to view the bright side of a challenging situation. Irrespective of their conditions, they keep a positive attitude at work.

- Service-oriented. Filipino contractors are inherently friendly to foreigners, newcomers, and strangers. Hospitality and warmth are part of Filipino culture. This means that workers often go above and beyond with their service.

- Resourceful. Many Filipino professionals are hardworking, responsible, and passionate about their careers. They think outside the box and seek creative ways to resolve task-related issues with patience.

Filipinos’ affirmative work characteristics help raise morale and teamwork, resulting in:

- Stronger staff retention due to high work satisfaction;

- Reduced absences and tardiness because workers stay highly motivated;

- Higher revenue resulting from increased output and efficiency;

- Better employee well-being because of reduced work stress; and

- Greater savings or decreased expenses due to fewer absences.

12. High English Proficiency for Better Interaction and Understanding

Filipino accountants are fluent in written and verbal English. The Philippines is a consistent top placer among Asian countries with high English proficiency, second only to Singapore.

Would-be Filipino CPAs typically spend four to five years in college or university to finish a bachelor’s degree. English is the medium of instruction in accounting courses. The standards and subjects of accountancy programs are the same in the U.S., Australia, and the UK. Upon graduation, Filipinos are remarkably familiar with Western accounting systems and procedures.

Strong English skills allow Filipino accounting professionals to interact quickly with clients and better understand their needs. Language barriers are fewer, enabling smoother and faster interactions and transactions. Maximize the benefits of outsourcing by ensuring third-party accounting teams and clients can clearly understand each other.

13. Progressive Internet Infrastructure for Flawless Communication

The Philippines built its internet infrastructure over several years. Eight internet service providers (ISPs) deliver high-speed connections across the country. These ISPs use fiber-optic technology to fulfill the growing demand in the primary cities such as Metro Manila, Angeles, Baguio, Metro Davao, and Metro Cebu.

These eight ISPs are:

- Starlink

- Smart Communications

- Red Fiber

- PLDT (previously known as Philippine Long Distance Telephone Company)

- One SKY

- Globe Telecom

- DITO Telecommunity

- Converge ICT Solutions

Starlink, Elon Musk’s ISP under SpaceX, is the latest entrant in the internet service industry. It went live in February 2023. The company uses space satellites to provide internet connection across the country, including far-flung and isolated locations. Starlink expects to offer at least 100 Mbps internet speed to subscribers.

Internet connectivity has progressed substantially since the new Philippine administration took over in late 2022. The government simplified the release of local government unit permits. As such, telecommunications and tech providers no longer have to wait for permits to build cellular towers and fiber-optic networks to improve internet speed.

Outsourcing processes call for a reliable and fast internet connection. With fast internet, a third-party accounting team can efficiently perform daily tasks and collaborate with coworkers, employers, and clients. Interaction is also seamless, providing a better communication experience for the parties involved.

14. Reduced Operating Expenses To Increase Working Capital

Bringing down ongoing costs is one of the main advantages of outsourcing accounting services to the Philippines.

Consider the cost savings when assigning processes to third-party vendors:

- Work supplies, office space, and equipment. Building an in-house accounting support team entails purchasing new computer systems (hardware, software, and network) and supplies. You also need extra office space. When support operations are at maximum levels, spending on maintenance and repairs is unavoidable.

- Compensation. An in-house accounting staff gets fixed salaries whether the business is bustling or sluggish. Companies also shoulder non-financial compensation, social security, income taxes, and unemployment insurance. A need to budget for overtime pay, sick leave, health insurance, and holiday pay might also arise.

- Upskilling. Keeping pace with the latest trends, developments, and practices is one of the duties of an accounting team. Members must update their skills and knowledge to address unfamiliar work challenges. Sending team members to seminars, post-graduate studies, and workshops to acquire new skill sets requires a bigger budget.

- Recruitment. Hiring more accounting employees increases costs. Recruitment includes setting aside a budget for job advertisements, third-party talent recruiters, and applicant screening, testing, and onboarding. A service provider can take on all these costly activities.

15. Scalable Outsourced Processes for Optimized Spending

One of the benefits of outsourcing accounting services to the Philippines is the ability to scale delegated processes per business situation, demand, and requirement. This capability lets companies better manage their budgets.

A BPO service provider supplies several accounting specialists within budget. It also addresses any staff-related issues or concerns. Outsourcing helps reduce the number of accounting professionals without laying off talent. The provider instead transfers the affected team members to different accounts.

During busy seasons, the service provider scales up its operations. It can provide more accounting staff during peak season, including major holidays and marketing campaign periods. Meeting demand by supplying extra manpower is the service provider’s specialty.

Scalability lets the client divide work between its in-house accounting department and the third-party team. This arrangement enables the in-house team to focus on complex and specialized functions; the third-party accounting crew deals with common and tedious tasks.

16. Trained Accounting Support Team for Accurate Output

When outsourcing accounting services to the Philippines, one significant perk is acquiring a team of experienced and competent professionals.

The third-party team includes CPAs, auditors, financial analysts, collection specialists, credit analysts, financial and accounting consultants, and managers—all capable of resolving different issues. They undergo intensive training in responding to clients’ needs and concerns.

Members of this accounting team possess the following soft and hard skills:

- Organizational skills

- Attention to detail

- Excellent communication and interpersonal skills

- Creative thinking

- Active listening

- Analytical skills

- Teamwork

- Familiarity with Windows, Linux, and macOS

The Bottom Line

Organizations benefit significantly from outsourcing accounting services to the Philippines. They get a large, cost-effective workforce that is flexible, educated, service-oriented, technically literate, and proficient in English. Adding to these are the country’s economy and the booming BPO industry.

Companies that want to outsource for the first time must start on a small scale and slowly. Hiring many workers, even with affordable labor costs, is not ideal. Hiring a small team can help you understand how outsourcing works in the Philippines.