IN THIS ARTICLE

Table of Contents

An increasing number of businesses are outsourcing their bookkeeping and accounting activities to offshoring providers in the Philippines. Many companies have experienced the benefits of delegating their back-end processes and the opportunities it brings.

Bookkeeping is one of the accounting operations that you must take seriously. It records and documents all of your financial transactions. It is your bookkeeper that you consult when reviewing your sales and expenses. However, bookkeeping mistakes can still happen.

This article discusses mistakes outsourcing bookkeeping to the Philippines can help you minimize.

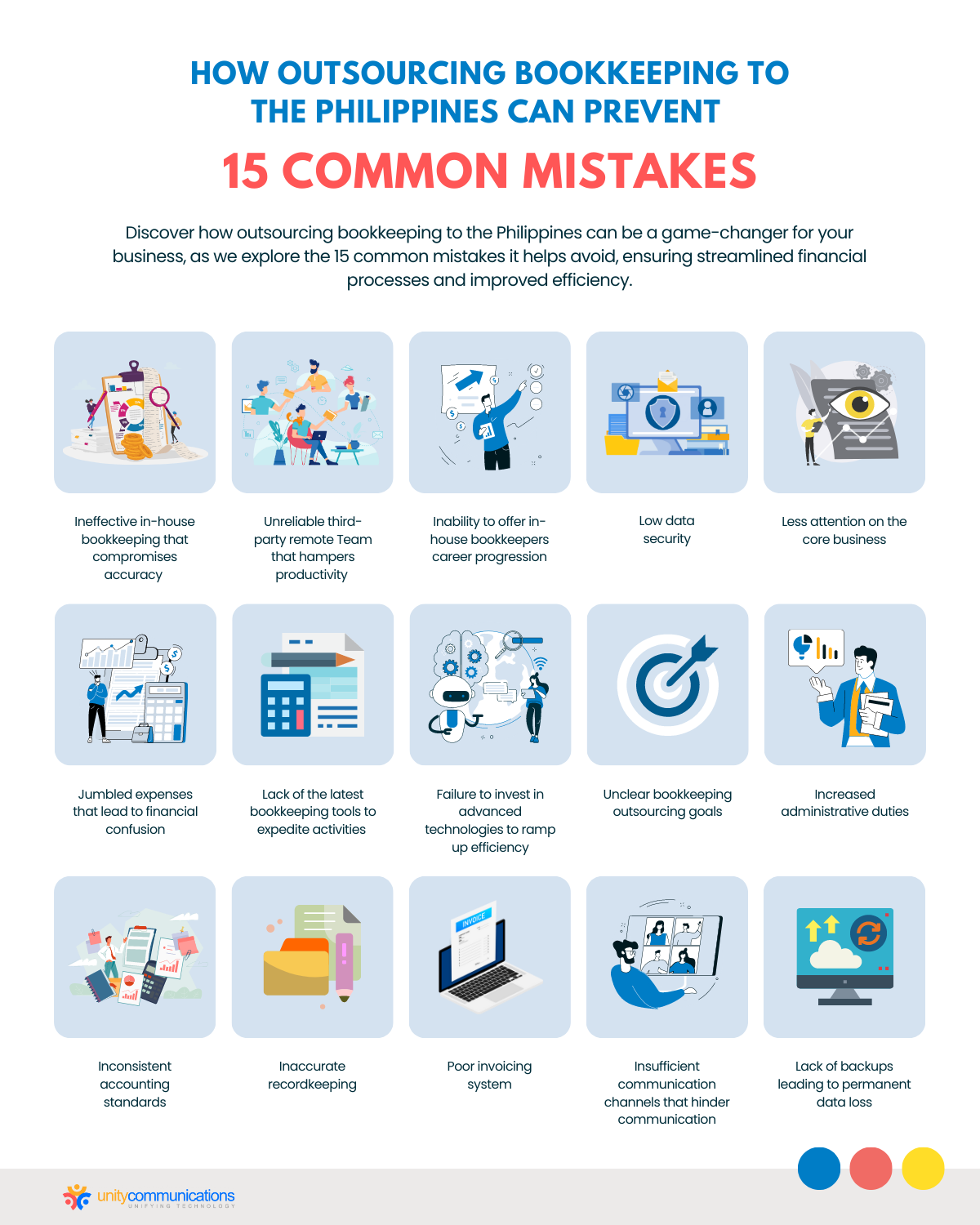

15 Mistakes Outsourcing Bookkeeping to the Philippines Can Help Avoid

Below are 15 mistakes in bookkeeping practices, systems, staffing, and operations that you must watch out for and that Filipino service providers can help you avoid.

1. Ineffective In-house Bookkeeping Team That Compromises Accuracy

With outsourcing bookkeeping to the Philippines, acquiring a team of competent and skilled professionals is within reach.

In addition to bookkeepers, the third-party contractors consist of certified public accountants (CPAs), collection specialists, financial analysts, accounting managers, financial consultants, and auditors. These workers can manage different duties and address challenging issues. They are trained to fulfill your business needs and interests.

Third-party bookkeepers and other accounting staff have the following soft and hard skills:

- Creative thinking

- Organizational skills

- Teamwork

- Active listening skills

- Familiarity with relevant applications

- Analytical skills

- Communication and interpersonal skills

- Attention to detail

2. Unreliable Third-party Remote Team That Hampers Productivity

You can outsource various tasks to remote teams in the Philippines, from bookkeeping and accounting to data entry services.

Bookkeeping outsourcing in the Philippines lets you partner with a service provider that has a dependable and well-trained remote team. Work-from-home (WFH) workers are free from doing tedious office-related activities such as commuting to and from work daily.

Filipino WFH contractors are reliable. They can improve productivity to help you achieve business goals. They are efficient due to the following reasons:

- Tight data security. Third-party workers apply virtual private networks (VPN) and the latest antivirus technologies to protect vital data from data threats and intrusions.

- Frequent virtual meetings. Accounting managers or supervisors regularly collaborate with team members through audio or video calls and direct messaging platforms (e.g., Skype and Slack) to get updates on work progress and issues.

- Structured WFH system. A service provider has straightforward WFH policies that remote workers must adhere to for better collaboration, productivity, and conduct.

- Well-geared remote team. Business process outsourcing (BPO) providers equip third-party contractors with the relevant computer software and hardware systems or devices to help them quickly and accurately complete their daily tasks.

3. Inability To Offer In-house Bookkeepers Career Progression

Retaining talented bookkeepers is one way to ensure continuous accounting operations. However, many employees leave to seek other career opportunities when companies fail to provide a promising career path.

A third-party company that provides bookkeeping outsourcing in the Philippines ensures the long-term retention of highly skilled professionals. It develops and presents a career path for employees in the following ways:

- Learning their professional roadmap. A service provider communicates with accounting workers, urging them to be transparent about their long-term goals with the company. It wants to know their career plans and how they envision themselves in the organization in the years ahead.

- Implementing a leadership or management training program. A BPO provider offers leadership initiatives to deserving and interested employees. This shows its sincerity in -+helping them advance to managerial or higher positions.

- Extending incentives, benefits, and rewards. An outsourcing company typically compensates top performers and those contributing significantly to operations. It also provides rewards and incentives to loyal and dependable employees.

- Assigning challenging but achievable duties. A BPO firm delegates tasks within a staff member’s capabilities. It encourages them to reach their potential and excel above their existing roles. The service provider aligns responsibilities with an individual’s strengths and skills but gives them more challenging ones occasionally.

4. Low Data Security That Puts Client Information at High Risk

Companies that do not invest heavily in the latest cybersecurity technologies may find that their in-house bookkeeping processes are at risk of sophisticated data breaches and privacy invasions.

When outsourcing bookkeeping to the Philippines, a third-party provider keeps sensitive and confidential data safe. It executes high-level security and privacy policies to safeguard vital information, including:

- Bank account numbers

- Credit card details

- Insurance information

- Investment accounts

- Medical records

- Passwords and usernames

- Payroll, compensation, and salaries

- Residential addresses

Cyberattacks and data compromises can harm your business image and operations. Hence, stringent privacy and security protocols are needed. Secure a non-disclosure agreement from the service provider to protect the data. Be clear that bookkeepers and accounting professionals have permission to access and use client data.

Additionally, data security must adhere to government regulations and industry standards to prevent illegal use. Non-compliance results in legal consequences that can undermine your finances and revenue.

5. Less Attention on the Core Business, Weakening Competitiveness

When you outsource accounting and bookkeeping processes, total business output, efficiency, and revenue should improve. However, outsourcing these back-end functions improperly might force you to spend more time, money, and effort on such functions than on your strong suits.

Outsourcing bookkeeping to the Philippines allows you to focus on your core competencies. A BPO provider deploys trained, experienced professionals who can get the job done.

As a result, you can improve your business competitiveness and revenue, so you can

- Raise current product and service conditions to drive sales and customer satisfaction;

- Invest more funds in staff training and upskilling to heighten efficiency, retention, loyalty, and morale;

- Purchase the latest tools and systems to speed up production and stay ahead of market competitors;

- Develop and launch new products and services, providing more choices for your target market; and

- Broaden the market base faster than expected to improve the income stream.

6. Jumbled Expenses That Lead to Financial Confusion

Many small companies include personal expenses on their business accounts. This practice must be avoided because it can lead to serious problems such as:

- Muddled data. When reviewing a long list of records or documents, it is difficult to differentiate business expenses from personal ones. This causes frustration and delays.

- Amateurish perception. Blending business and personal accounts can dissuade investors interested in providing capital for your business or purchasing company shares.

- Inaccurate tax figures. Combining both accounts makes it harder for your accountants and the Internal Revenue Service (IRS) to calculate your tax obligations.

- Legal issues. Mixing up accounts might put you in difficult legal situations. You must submit your personal assets and properties for examination in a court case.

- Lengthy bookkeeping activities. Your accounting professionals spend more time organizing your books and preparing financial statements when you need them.

Outsourcing your bookkeeping activities to the Philippines can help you address these potential problems. A service provider offers methods to separate business and personal expenses. For example, it can offer the following solutions:

- Opening an account for business finances. A third-party team can arrange a business cash management account to sort out your finances at the onset. This account enables you to make and collect payments related to business operations.

- Monitoring expenses and keeping receipts. Third-party bookkeepers organize everything from the smallest to the biggest transactions. They include it in the relevant account whenever you buy or sell something.

- Paying you a salary. Instead of withdrawing money from the business account, your bookkeepers set up a salary account for your expenses.

- Securing requirements. A third-party contractor handles all the requirements for setting up company and business accounts.

7. Lack of the Latest Bookkeeping Tools to Expedite Activities

Back-office outsourcing enables access to advanced platforms, technologies, and applications that streamline operations. Thus, bookkeeping outsourcing to the Philippines helps deliver first-rate services by minimizing human mistakes and overseeing workflows more efficiently. These applications can be integrated into a cloud network for convenience and scalability.

Here are some examples of bookkeeping and accounting software:

- Zoho Books aids small businesses in handling finances and cash flow. It enables bookkeepers to automate processes and coordinate with other teams. The application also includes user-friendly tools for time-tracking, inventory management, financial reporting, and banking.

- Plooto is an accounting program that reduces manual recording activities by automating accounts payable. It also processes payments in a central location to provide bookkeepers with a more accurate analysis of cash flow and finances.

- FreshBooks is an intuitive invoicing application that helps bookkeepers with tedious tasks. They can encode billable expenses and time, schedule payment reminders, generate numerous reports, automate recurring invoices, and customize invoice documents.

- Oracle Netsuite delivers complete accounting and enterprise resource planning (ERP) features. It assists bookkeepers in making reports, managing taxes, and collecting payments.

8. Failure To Invest in Advanced Technologies To Ramp up Efficiency

Many technologies used by in-house bookkeepers are likely conventional. Using proven, traditional, and proven tools is good, but harnessing next-generation tools is better.

Outsourcing bookkeeping to the Philippines lets you access future technologies that can take productivity and performance to the next level. Sophisticated applications and platforms facilitate communication lines and help quickly fulfill client requirements and objectives.

Examples of said technologies include:

- Robotic process automation (RPA) is an automated and intelligent software that performs specific functions to help employees focus on critical and immediate tasks.

- Artificial intelligence (AI) imitates human intelligence in digital devices and machines. Incorporating AI applications into your workflow lets you attain economies of scale to reduce costs.

- Omnichannel solution is a technology unifying all communication modes into a single platform for flawless interaction with clients and customers regardless of location and time.

- Cybersecurity is an advanced security technology that protects your information technology (IT) systems, including software, data, hardware, and network, from online attacks and threats.

- Cloud computing enables all software applications utilized in outsourced services to operate virtually and remotely for cost-effectiveness and scalability.

9. Unclear Bookkeeping Outsourcing Goals Producing Undesired Results

Having vague outsourcing objectives is one error many companies must rectify when delegating bookkeeping processes. With a carefully developed plan, you only look for the cheapest service fee; the outcome might be below your expectations.

A service provider that offers bookkeeping outsourcing in the Philippines can help you define your goals, requirements, and current situation before entering into a partnership. These goals can include the following:

- Focusing on strong suits to develop the latest product or service

- Establishing a market presence quicker to lower spending

- Obtaining up-to-date technologies to streamline workflows

- Cutting ongoing expenses to increase investment funds

- Improving customer or brand loyalty for repeat business

- Achieving a competitive edge for better profit margins

- Attaining more agility to better respond to unexpected situations

The third-party provider can also help you fill in the details of your outsourcing needs, such as:

- Choosing the type of outsourcing. BPO providers engaged in bookkeeping and accounting are classified into five categories according to their location: offshore, nearshore, onshore, on-site, and multiple outsourcing.

- Picking the right channel support. A service provider shares its knowledge of clients’ preferred communication channels. Social networks (LinkedIn, Instagram, Facebook, TikTok, and Twitter), messaging apps (Line, Messenger, Skype, and WhatsApp), email, live chat, and phone calls are examples of channels.

- Getting the exact team size. The number of outsourced bookkeepers and other accounting professionals you need depends on your daily workload and transaction volumes.

10. Increased Administrative Duties That Increase Operating Costs

Whether you outsource tech solutions or bookkeeping and accounting functions, the third-party provider deals with the recruitment processes, from advertising employment and pre-screening candidates to training new hires. The BPO provider can also monitor staff income tax returns and attendance and submit reports for you to check.

Likewise, Philippine bookkeeping outsourcing includes human resources (HR) management to lessen administrative responsibilities and operating expenses.

You enjoy the following perks when allowing a service provider to take over HR operations:

- More time for higher-value functions. Most HR processes are tedious and burdensome. Assigning these routine tasks to a third-party provider is a more practical option.

- Large talent pool. A BPO provider has extensive and tested recruitment procedures to discover qualified candidates for bookkeeping and accounting positions.

- Stress-free activities. An outsourcing company’s HR team helps the third-party team follow government policies and industry standards to avoid fines, penalties, and infractions.

11. Inconsistent Accounting Standards That Affect Credibility

One of the bookkeeping mistakes many in-house operations commit is not aligning their practices with international accounting standards. This might result in litigation or fines that adversely affect the general public’s and relevant stakeholders’ sentiments.

Your company is in good hands when outsourcing bookkeeping to the Philippines. The country’s accounting procedures match the International Financial Reporting Standards (IFRS) published by the International Accounting Standards Board (IASB), a London-based non-affiliated accounting and financing organization.

Companies in over 120 countries pattern their accounting methods after the IFRS’ reporting processes. The Philippines’ generally accepted accounting principles (GAAP) are the Philippine Accounting Standards (PAS) and the Philippine Financial Reporting Standards (PFRS). Both standards also base their practices on IFRS.

GAAPs differ from nation to nation owing to economic, legal, cultural, and political dissimilarities. Despite the distinctions, Filipino bookkeepers and accountants are recognized for their versatility. They quickly learn about their client’s country’s accounting standards and government regulations.

Filipino accounting professionals can also adapt to and handle different accounting procedures and measures. Their world-class competence is one reason global accounting firms (e.g., Klynveld Peat Marwick Goerdeler, Ernst & Young, PricewaterhouseCoopers, and Deloitte) established operations in the Philippines.

12. Inaccurate Recordkeeping That Translates to Higher Financial Costs

Different risks will emerge if your in-house bookkeeping and accounting team fails to stay on top of recordkeeping operations. These risks can eventually hurt your business. Some potential consequences include the following:

- Cash flow issues. Poor bookkeeping practices result in more money flowing out of your business than coming in. Lack of liquidity leads to delays in paying loans, bills, supplier invoices, and salaries.

- Overdue taxes. Messy books lead to late tax filing, which leads to paying fines and penalties. Failure to pay taxes on time can also cost you to pay interest on unpaid legal obligations.

- Product and service pricing inaccuracies. Determining the right prices for your products or services is challenging, with weak cost monitoring and recording. You cannot optimize profit margins with poor pricing.

Bookkeeping outsourcing to the Philippines can help you minimize, if not eliminate, these potential issues. A BPO provider employs trained and experienced bookkeepers and accountants who can perform accounting operations efficiently. Below are some methods they apply:

- Automate cloud-driven bookkeeping solutions. This technology allows bookkeepers to organize monthly paperwork, do manual calculations, and review spreadsheets. Cloud-based applications facilitate most of the accounting work.

- Establish an audit trail. Outsourced Filipino bookkeepers accurately record the details of a transaction, ledger entry, or work event. They can help you track back documentation should issues arise, such as missing transactions and tax discrepancies.

- Monitor cash payments. Third-party contractors can record every disbursement, settlement, and purchase made. Every cent is documented. The BPO team can note that all customers, suppliers, and employees are paid for an orderly bookkeeping system.

- Train team members regularly. The service provider requires the third-party team to continuously learn and upskill to keep up with new bookkeeping and accounting procedures and developments.

13. Poor Invoicing System That Might Cause Customer Mistrust

Invoicing entails sending an itemized document that shows the products or services completed for or delivered to the customer. The document also includes the total amount due and the preferred payment methods.

An inefficient invoicing process can hurt your cash flow because payment collections are delayed or incorrect. Errors can also cause customer mistrust and confusion between the parties. You might lose customers if you do not address these problems quickly.

Invoicing processes improve with bookkeeping outsourcing in the Philippines. A third-party team uses best practices to ensure operations and collections are maximized. Below are examples of best practices:

- Triple-check information. Filipino bookkeepers are thorough and do not miss the verification processes.

- Set a process. The service provider ensures that all members receive sufficient training to keep accounting operations running smoothly. Its financial manager oversees everything, including compliance checks.

- Settle bills on time. The BPO provider can help you establish lasting customer and supplier relations by paying your invoices before the due date. Vendors and suppliers typically give preferential treatment when you pay promptly or early.

- Take advantage of automation. Many service providers use automation for invoice processing to save clients money and time. Smart bots perform different tasks, such as verifying invoices and documenting payment entries.

14. Insufficient Communication Channels That Hinder Communication

Bookkeeping outsourcing to the Philippines enables multichannel communication. You can seamlessly interact with the third-party team via different digital devices and channels anytime and anywhere. Continuous interaction, enabled by contact center as a service (CCaaS) solutions, contributes to the success of outsourced activities.

A BPO provider can offer the following channels to keep clients in the loop:

- Live chat – a small messaging panel on your company website

- Chatbot – an intelligent app that quickly answers common and simple questions

- Voice over internet protocol (VoIP) telephony – for internet-dependent clients with VoIP-based gadgets such as VoIP phones

- Standard phones – traditional fixed landlines for voice calls

- Social media – lets you and the bookkeeping team interact on social networks (e.g., Instagram, Twitter, and Facebook)

- Email – electronic messaging system for sending large files and long-form correspondence

- Short message service (SMS) – short text messages sent via mobile devices (e.g., smartphones, tablets, and cell phones) for quick requests and responses

15. Lack of Backups Leading to Permanent Data Loss

You risk losing critical information (e.g., customer, employee, and supplier files, financial data, and tax documents) if you do not back it up or have multiple, separate copies. Huge delays, stress, and financial damage ensue when data is lost. Personnel negligence, computer hacking, or online theft are the main reasons for data loss.

Bookkeeping outsourcing in the Philippines can help you avert such a data disaster. A third-party provider employs bookkeepers and other accounting workers familiar with the technical aspects of outsourced tasks.

Additionally, the service provider has different approaches to guaranteeing bookkeeping data and information are backed up, secure, and safe. Below are some examples:

- Cloud accounting systems. The BPO provider has solutions that allow you to perform bookkeeping, financing, and accounting operations online while ensuring the data being exchanged is accessible and secure.

- Local data backups. The outsourcing company backs up the data in one or a combination of three ways: on-site server, a backup gadget or appliance, or a data center off-site.

- Backup as a service (BaaS). The third-party company also provides or subscribes to this service. BaaS is an off-site data repository in which data is constantly backed up to remote cloud-based data storage through a secure network.

The Bottom Line

Bookkeeping outsourcing to the Philippines should be among your top priorities if you need to record and organize your company’s revenue, costs, and cash flow more effectively. It is a practice that streamlines your accounting activities to help you with budgeting, auditing, and forecasting. It also prevents errors that lead to financial losses or penalties.

If done properly, outsourcing can considerably assist you in your financial processes. Learn how and when to outsource bookkeeping so that you can enjoy the benefits of enhanced back-office operations.

Are you interested in bookkeeping outsourcing in the Philippines? Let’s connect and discuss how we can help you.