IN THIS ARTICLE

Table of Contents

Ever-changing regulations, national issues, and market drivers contribute to growing competition in the insurance industry. These factors also lead to operational challenges in reducing turnover ratios and developing reasonable pricing models for businesses.

Insurance helps your clients maintain financial protection in case of an emergency. However, if customers find a more affordable option, they do not hesitate to take advantage of it by changing their insurance carrier. This increased demand means more work for your team.

Outsourcing offers practical ways to ease your workload. Read through the end to know how insurance business process outsourcing can support your growth and your customers’ needs.

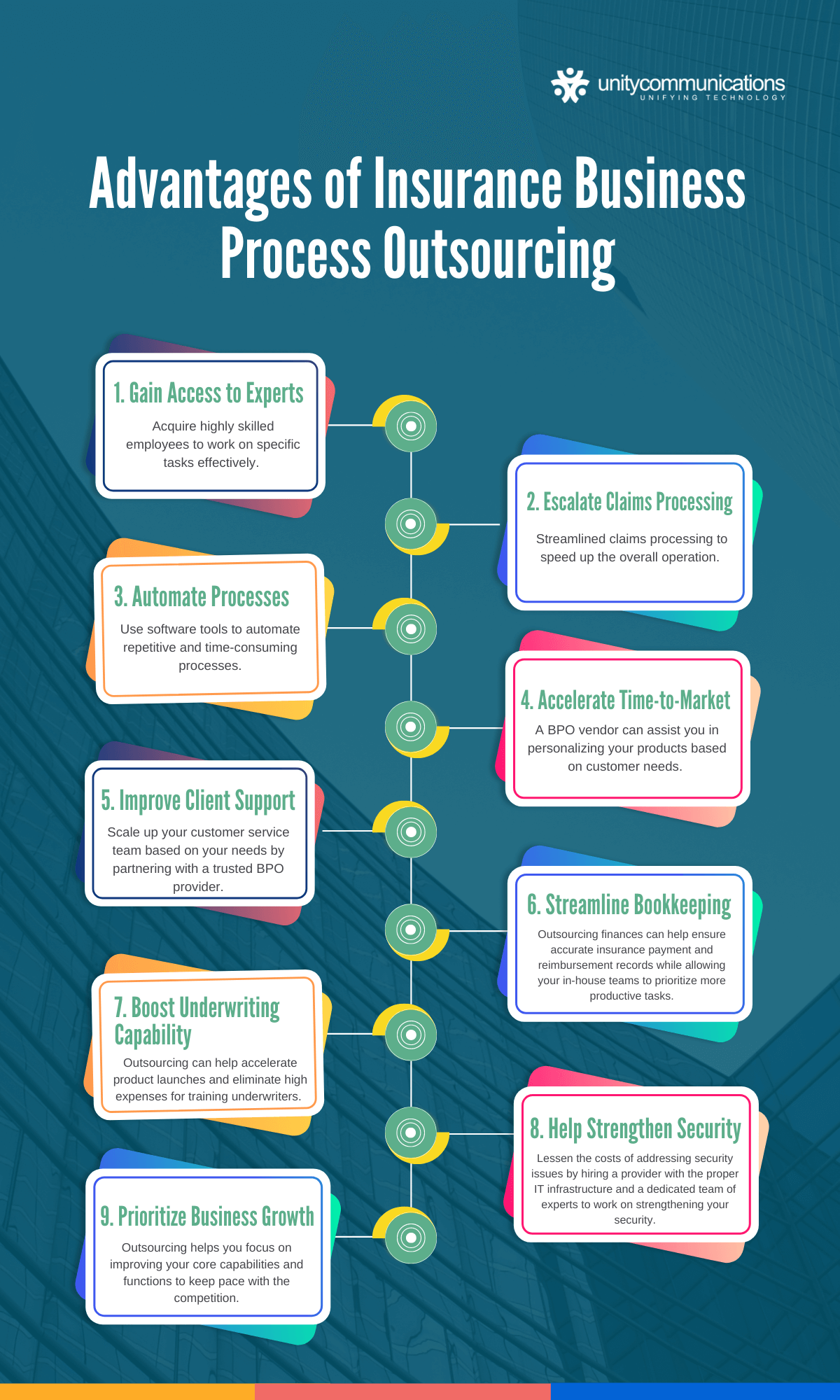

9 Advantages of Insurance Business Process Outsourcing

Insurance is a financial contract under which an individual or business obtains financial protection and receives reimbursement against losses from an insurance company. The insurance policy consists of terms and conditions settled upon by an insurer and a policyholder for claims processing.

Since many eligible people and enterprises seek insurance, an insurer encounters backlogged policy management tasks and claims processing tasks. Therefore, an insurance company needs to expand its teams to meet the increasing demand. However, it can face high expenses for training more employees, adding equipment, and opening new office space.

Outsourcing is the best option if you want your insurance business to achieve profitability and expand further while maximizing the investment of limited resources. This approach allows you to do more while paying less.

But before hiring a third-party service provider to help boost your efficiency while reducing costs, you need to understand the benefits of insurance business process outsourcing.

1. Gain Access to Experts

The insurance industry sees a potential talent gap because of its aging experts. Based on the U.S. Bureau of Labor Statistics shared by AmTrust Financial, nearly 400,000 aging employees are projected to retire from the insurance industry workforce within the next few years.

As a result, most insurance businesses are turning to business process outsourcing to address the looming talent shortage. Whether onshore, nearshore or offshore, an outsourcing provider has highly skilled employees who can effectively work on specific tasks. They also undergo regular training by attending workshops, seminars, and other skill-enhancement-focused events.

You can expect personnel from third-party service providers to have undergone a rigorous process of behavioral and skill assessments during their hiring and onboarding period. In this way, you can be confident that these employees are highly capable of efficiently carrying out your insurance policy and customer support tasks.

2. Escalate Claims Processing

Technology modernization accelerates insurance claims management, which traditionally involves pens, papers, and filing cabinets. However, high operating costs remain a barrier to streamlined claims processing. Also, inconsistent team performance, caused by the need to fulfill other duties, hinders the modernized approach.

Adopting insurance business process outsourcing helps you speed up the processing and accomplishment of claims. Since a BPO provider has skilled and trained employees, expect that they already know what they are doing. They just need a short overview of their work’s dos and don’ts so that they can best accomplish their assignments.

Modernized systems further accelerate these activities. Outsourced talents can use these platforms to develop templates and categorize insurance records properly. Combining a talented workforce and advanced technology can thus help you achieve increased productivity and efficiency.

3. Automate Processes

Similar to inventory management, BPO providers use high-tech systems to streamline the handling of massive numbers of insurance policies and claims. From providing customer support to managing insurance data, they deploy software tools to automate some repetitive and time-consuming processes.

Although human intervention is still needed, these automated systems help ease workloads. The platforms help outsourced employees achieve good quality outcomes and meet deadlines. Automation also allows you to reduce backlogs and increase core competencies.

Such benefits can be experienced when adopting data entry outsourcing, which involves handling and organizing large amounts of insurance information. A BPO provider can also help protect your data through strict privacy and security rules incorporated into autonomous software tools.

4. Accelerate Time-to-Market

The insurance industry is heavily regulated because it involves complex contract terms. Governments worldwide need to control it to protect the interests of policyholders and balance the competition among insurers. Therefore, launching a new insurance product requires undergoing rigorous processes and passing stringent requirements.

Seeking help from a BPO provider can reduce the time needed for your new insurance product to reach the market. The outsourcing partner’s skilled workers can prioritize performing the necessary assessments for your planned offering. They can help ensure that it meets federal standards for the insurance industry.

Furthermore, insurance business process outsourcing enables you to apply the direct-to-consumer sales model when introducing your new insurance product. It has a sales team with experienced and licensed agents who know how to listen to your customers. Thus, a BPO vendor can assist you in personalizing your products based on customer needs.

5. Improve Client Support

Your insurance company will not exist if there are no policyholders. Hence, you have to prioritize your client’s needs and demands. You should continue exploring ways to enhance your customer support services.

You can set up an in-house team to handle all programs and tasks that accommodate your clients’ inquiries, concerns, and issues. To make the team more effective, you need to regularly train your employees, upgrade your systems, and analyze customer ratings. However, these measures could cost you more than your set operational budget.

Outsourcing policyholder support services can help you lower your expenses by eliminating the need to hire or train more employees. A front-office outsourcing services provider also has dedicated systems and workplaces to house skilled client support agents. You can even discuss the service packages that match your operating budget with your outsourcing partner.

6. Streamline Bookkeeping

Bookkeeping is critical to keeping your financial files structured but does not necessarily contribute to your insurance company’s growth. Keeping your financial processes running is merely a part of your daily routine. Time used for bookkeeping is more worthy of being spent helping grow your business.

Outsourcing finances can help ensure accurate insurance payment and reimbursement records while allowing your in-house teams to prioritize more productive tasks. You can also expect to receive comprehensive reports on financial transactions involved in every insurance policy.

Moreover, outsourced bookkeeping offers enhanced visibility of your financial data. These classified records prepared by your insurance business processing partner can assist with more informed decision-making.

7. Boost Underwriting Capability

Identifying the risks of insuring a client is a primary reason for performing underwriting. Through this process, you examine whether your client poses an acceptable risk and calculate a fair price for coverage if they do. Underwriters also play an important role in launching new products and setting up premium payments.

With increasing cost pressures and demands for introducing new insurance packages, most insurers do not prioritize maintaining an in-house team of underwriters. They find outsourcing to be the key to accelerating product launches and eliminating high expenses for training underwriters.

Since an outsourcing provider has advanced systems in place, you can employ it to perform specialized underwriting work. The contractor can serve as your key to achieving a competitive advantage in the insurance market.

8. Help Strengthen Security

Like other industries, the insurance market is not safe from threats. Since it involves money and confidential data, malicious actors will always find a way to compromise an insurance company’s systems for their gains.

Insurance businesses ‘ most common cybersecurity threats are identity theft, data breaches, hacking, phishing, and ransomware attacks. Responding to these incidents makes companies spend more because they need to upgrade their IT infrastructure and hire an expert to manage security.

Employing a third-party service provider helps lessen the costs of addressing such security issues. The outsourcing vendor has strict rules and regularly upgraded, modernized systems equipped with multi-factor authentication and encryption to protect sensitive information and processes. It also has a dedicated team of experts to work on strengthening your security.

9. Prioritize Business Growth

Facilitating your ability to focus on growth is the most important advantage of insurance business process outsourcing. Delegating front- and back-office tasks solely to your in-house team steals away the opportunity to plan new strategies to step up your brand. These monotonous processes also slow down your progress in the middle of a fast-paced, competitive environment.

Procuring front- or back-office outsourcing services frees up workloads while only paying fixed rates that match your operational budget. Moreover, you can reinvest the supposed funds for establishing your in-house teams to enhance the quality of your insurance products.

Most importantly, you can give ultimate priority to the one area of expertise that might help you get to the top and achieve your business goals. You can also focus on improving your core capabilities and functions to keep pace with the competition.

5 Tips for Choosing the Best BPO Provider

According to ReportLinker, the global insurance business process outsourcing market could reach $8.3 billion by 2027. The France-based professional search engine added that the market will expand at a 4.9% CAGR from 2020 through 2027.

The figures show that the insurance industry continues to see the importance of outsourcing in enhancing daily services, handling large-scale documents, and generating savings. Insurance companies aim to lessen their backlogs and expenses by tasking a BPO company to respond to requests and applications from individuals and enterprises seeking to be insured.

If you want to improve your insurance business, you must collaborate with a third-party service provider capable of efficiently completing your tasks and helping minimize costs. Follow these practical steps to select the right insurance business process outsourcing partner.

#1: Clarify Business Goals

Make a concrete list of the business objectives you aim to achieve through outsourcing. Identify the specific tasks you want to outsource and strategies for handling them.

Pin down which back-end and front-office processes need improvements. These measures help ensure that the potential BPO partner can meet your needs.

#2: Perform Background Checking

Study a third-party service provider’s history and experience in the insurance business process outsourcing industry. Know its market reputation, project management expertise, and working environment.

Seek feedback from current or former clients regarding the vendor’s quality of service. These approaches will help inform your decision to make an outsourcing investment.

#3: Differentiate Service Packages

Look for an outsourcing company that can offer quality service at an affordable cost. Select at least three bidders and compare their service packages.

Carefully analyze the tasks they can perform effectively and their pricing. These steps will allow you to plan your outsourcing budget based on your operational needs and limitations.

#4: Examine Work Culture

Check how the potential BPO contractor performs its activities. Review its work ethics, leadership, and management to identify whether it can appropriately and rapidly accomplish your tasks.

Ensure that the provider’s work culture promotes equality, diversity, and inclusion. These will guide you on whether the vendor can align with your company’s own culture.

#5: Learn Communication Strategies

Research different channels the outsourcing firm uses to relay its enterprise-wide messages, notifications, and announcements. Do not hesitate to ask about the contractor’s collaboration tools and communication systems to support your future projects.

Finally, question the vendor’s ability to provide insights and suggestions related to potential business process advancements and improvements. These actions will ensure active engagement and cooperation with your BPO partner.

The Bottom Line

Owning an insurance company allows you to provide people and enterprises with financial security in preparation for losses due to unexpected events. You can see a long line of clients willing to pay premiums in exchange for promised coverage or reimbursement in case of emergency. These factors result in increased workloads and backlogs for your in-house team.

Optimizing insurance business process outsourcing helps you address these challenges while enabling you to further expand your company. A BPO partner delivers highly trained employees and upgraded systems to automate administrative processes. The third-party service company’s experts can also assist you in accelerating the launch of your new insurance products.

If you want to experience how a BPO provider can improve your insurance business, contact Unity Communications to get a quote now.