IN THIS ARTICLE

Table of Contents

Businesses, organizations, governments, and offshoring providers gather statistics and other facts and figures to assess performance, measure productivity, and establish trends. They analyze this complex data from credible sources to gain insights that help them make better decisions.

This article curates relevant and up-to-date facts about the Philippine outsourcing industry. It provides basic analysis and insights to give organizations leads for outsourcing strategies.

Use this as a reference when planning to outsource operations to the country.

Statistics of the Philippine Outsourcing Industry

The Philippine outsourcing industry is a major economic pillar. It has contributed considerably to the country’s employment- and revenue-generation activities. The business process outsourcing (BPO) sector has been helping improve the nation’s gross domestic product (GDP) for several years.

According to the IT and Business Process Association of the Philippines (IBPAP), the country’s information technology and business process management (IT-BPM) sector grew in terms of the number of workers and revenue in 2022.

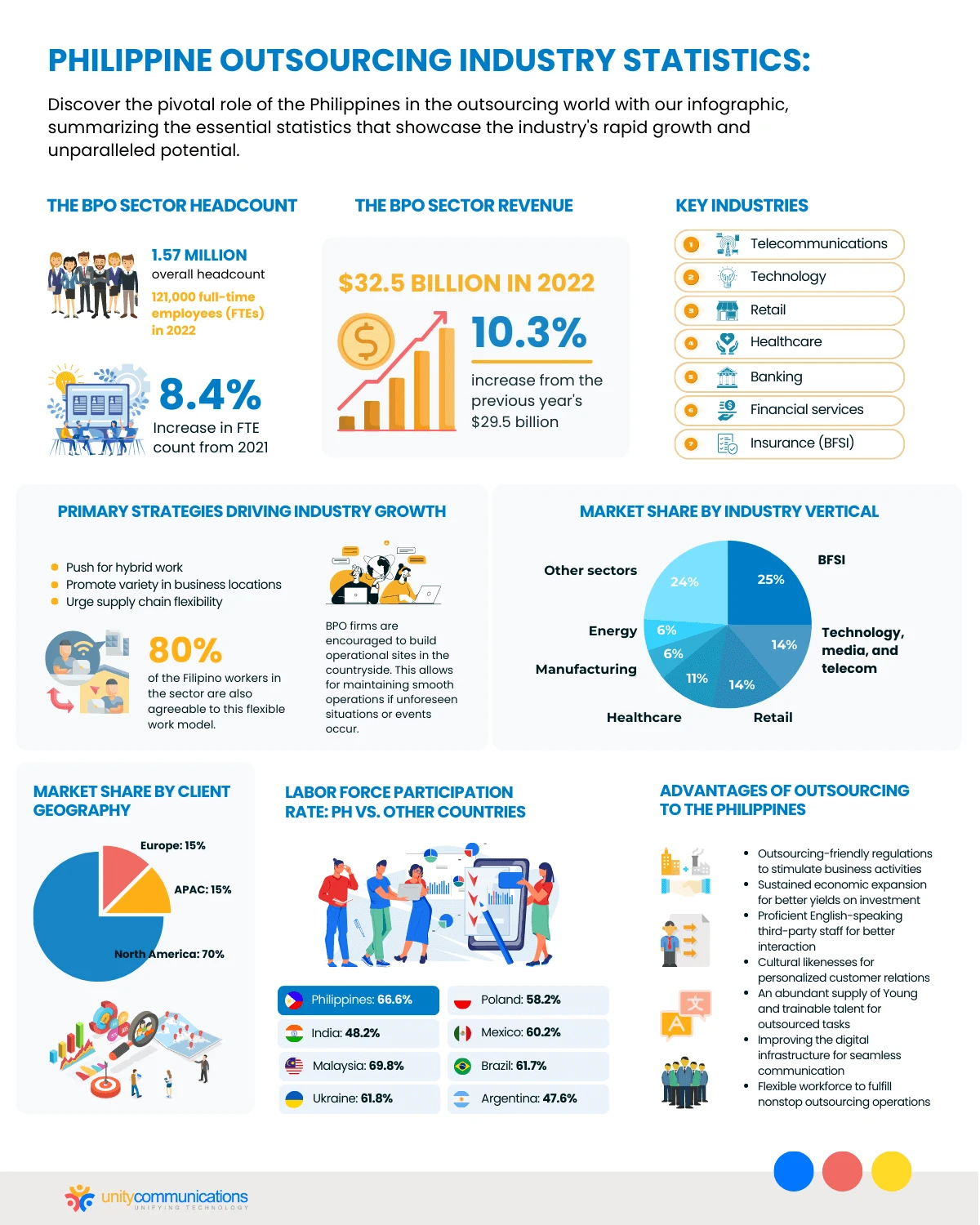

IBPAP reports the Philippine outsourcing industry hired an additional 121,000 full-time employees (FTEs) in 2022, an 8.4% increase from 2021. This addition brings the BPO sector’s overall headcount to 1.57 million. The industry also brought in $32.5 billion in revenue, 10.3% higher than the previous year’s $29.5 billion.

The group attributes this increase to the demand for outsourcing services from key industries, such as telecommunications, technology, retail, healthcare, banking, financial services, and insurance (BFSI).

IBPAP adds that the job expansion was mainly felt outside Metro Manila, in Pampanga, Laguna, Davao, Bacolod, and Cebu. Over 70,000 (or 58%) of the 121,000 new jobs were in the countryside. The organization also expects to hit its 2023 target of 1.7 million FTEs and $35.9 billion in revenue, resulting in an 8%-plus and a 10% increase from 2022.

![[Graph] Philippine IT-BPM Market Revenue Growth](https://unity-connect.com/wp-content/uploads/2023/07/Philippine-IT-BPM-Market-Revenue-Growth.png)

![[Graph] Philippine IT-BPM Headcount Growth](https://unity-connect.com/wp-content/uploads/2023/07/Philippine-IT-BPM-Headcount-Growth.png)

Source: IBPAP data

Note: 2023E = estimated figure for the year 2023

Outlook for the Philippine Outsourcing Industry

IBPAP president and chief executive officer (CEO) Jack Madrid expects the BPO industry to contribute over $59 billion in revenue, accounting for 8% of the country’s GDP, and provide an additional one million jobs before the end of 2028.

Madrid notes that the Philippine outsourcing industry has endured the pandemic’s adverse economic effects (e.g., lockdowns and social distancing). The high inflation that hit the local economy did not affect the sector either. It bucked the downtrend, generating over 125,000 jobs between 2020 and 2022.

He cites three primary strategies to drive the BPO sector’s growth and reinforce its global competitiveness in the next five years. These are:

- Push hybrid work further. Seven of 10 companies, or 70% of IT-BPM companies worldwide, are open to adopting a hybrid work arrangement for their employees. This work setup combines remote work and in-person work. 80% of the Filipino workers in the sector are also agreeable to this flexible work model.

- Promote variety in business locations. Third-party vendors are encouraged to consider establishing their operational sites in the countryside. One advantage of harnessing microsites or small-scale establishments is that vendors can maintain smooth operations if unforeseen situations or events occur.

- Urge supply chain flexibility. Outsourcing companies must prepare for labor shortages and foreign competition for qualified personnel. They must obtain the right human resources and upskill them to address the rising demand for specialized skills in advanced cybersecurity, cloud computing, and automation.

Madrid believes industry associations must work with government agencies and partners to implement these strategies effectively. He adds that the Philippine outsourcing industry can maintain the uptrend by improving digital infrastructure, streamlining business procedures, and bridging the labor supply and demand gap.

The Philippine Outsourcing Industry by Market Distribution

In the IT-BPM Industry Roadmap 2028 Executive Summary, IBPAP reports that IT services account for 16% to 18% of the Philippine outsourcing industry’s total revenue, while BPM services account for 82–84%.

IBPAP’s Philippine Roadmap report grouped IT-BPM services into industry verticals, buyer geographies, and sourcing models. Let us look at the breakdown.

Market Share by Industry Vertical

BFSI is the biggest industry outsourcing its processes to the Philippines. The country is also among the world’s leading locations for healthcare service delivery by headcount. Under healthcare, the processes that reach medium-to-high maturity are medical coding and billing, claims review, denial management, and care management.

Here is a breakdown of the market share by industry:

| BFSI: | 25% |

| Technology, media, and telecom: | 14% |

| Retail: | 14% |

| Healthcare: | 11% |

| Manufacturing: | 6% |

| Energy: | 6% |

| Other sectors: | 24% |

| 100% |

Market Share by Buyer Geography

North America, consisting of the U.S. and Canada, remains the Philippines’ biggest outsourcing customer by geography. This can be attributed to the sizable supply of English-speaking Filipino workers with neutral accents who can work with time zone differences, offer affordable service rates, and gain rapport with Western clients due to their shared cultural traits.

Europe taps the Philippine outsourcing industry for common IT-BPM services (e.g., call center and data entry services) due to the nation’s cost-effective labor and skilled talent.

Asia Pacific (APAC) is considered a fast-rising buyer market. It offers huge potential for the Philippines’ BPO sector due to its geographical proximity, time zone overlap, and low offshoring penetration.

Here is the market share by buyer geography:

| North America: | 70% |

| Europe: | 15% |

| APAC: | 15% |

| 100% |

Market Share by Sourcing Mix

IBPAP reports that for the last ten years, the country’s global in-house sector increased by 5% to 7%, reached a revenue of about $7 billion, and had a headcount of at least 220,000 FTEs in 2022. Global in-house centers (GICs) have contributed significantly to the Philippine outsourcing industry.

Market share by sourcing mix:

| Service providers: | 75% |

| GICs: | 25% |

| 100% |

The Philippine Outsourcing Industry by Services

IBPAP notes that the Philippine outsourcing industry comprises major functions such as contact center and BP services, IT services, and healthcare services.

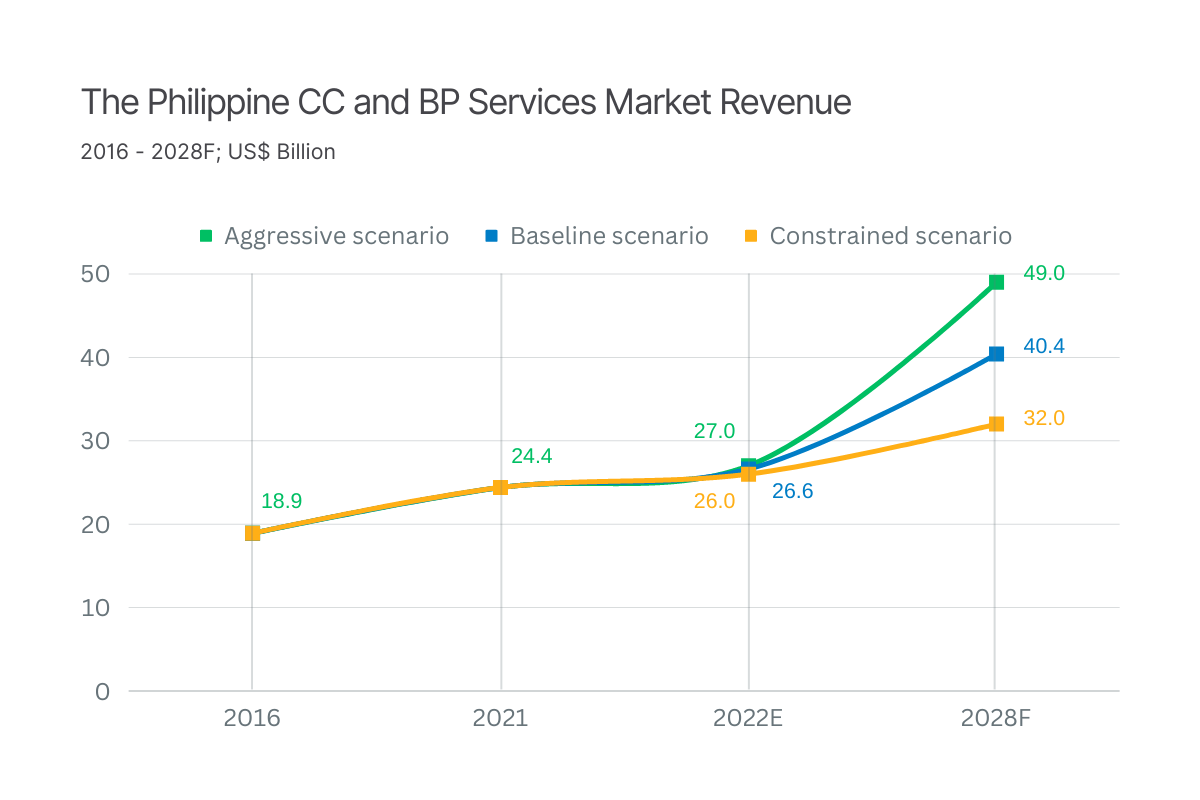

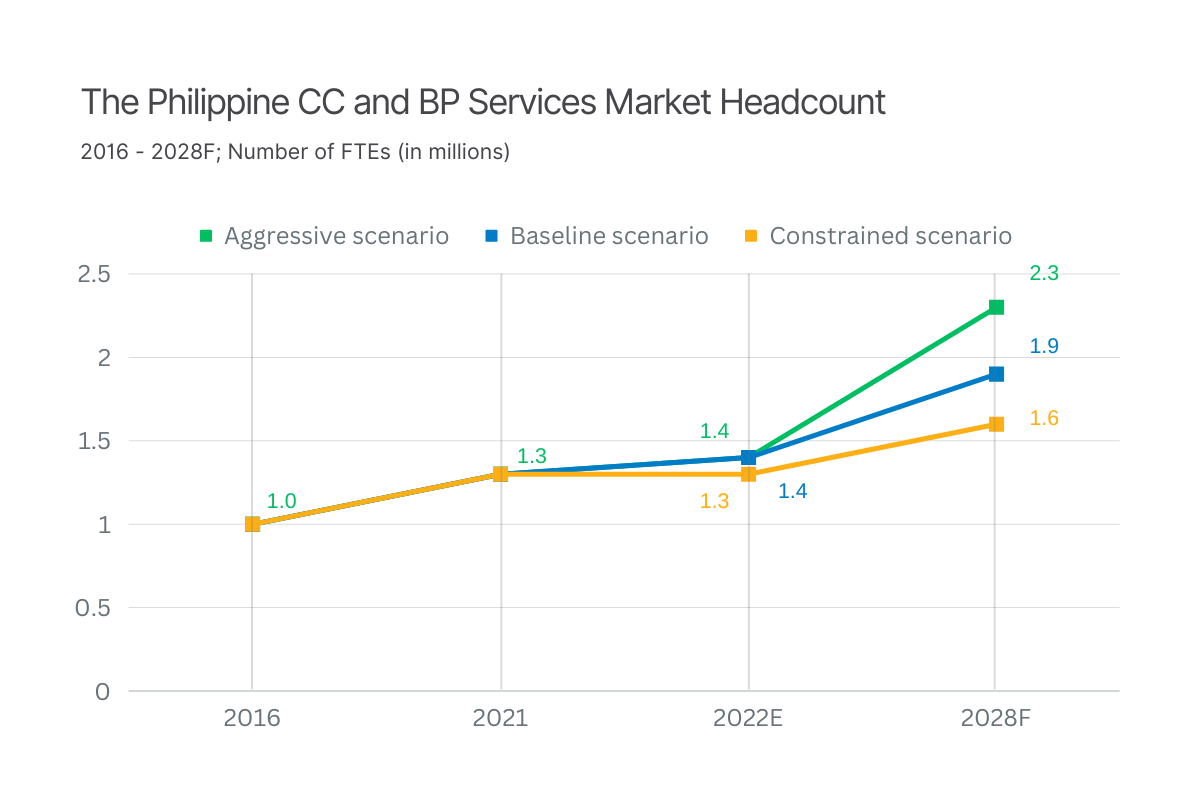

Contact Center and BP Services

The country is a leading destination for delivering contact center (CC) and BPM activities. CC services include customer service, technical support, and sales services. BPM services encompass finance and accounting (accounts receivable and payable), human resources (payroll), and industry-specific services (healthcare and BFSI BPM).

The growing demand for new BPM services such as financial planning and statistical analysis, supply chain management, and digital custo

mer experience management will help boost the revenue and headcount of the Philippine outsourcing industry in a couple of years, as shown below:

Source: IT-BPM Industry Roadmap 2028 Executive Summary, IBPAP

Notes: 2022E = estimates for 2022; 2028F = forecast for 2028; CC = contact center; BP = business process; FTEs = full-time employees

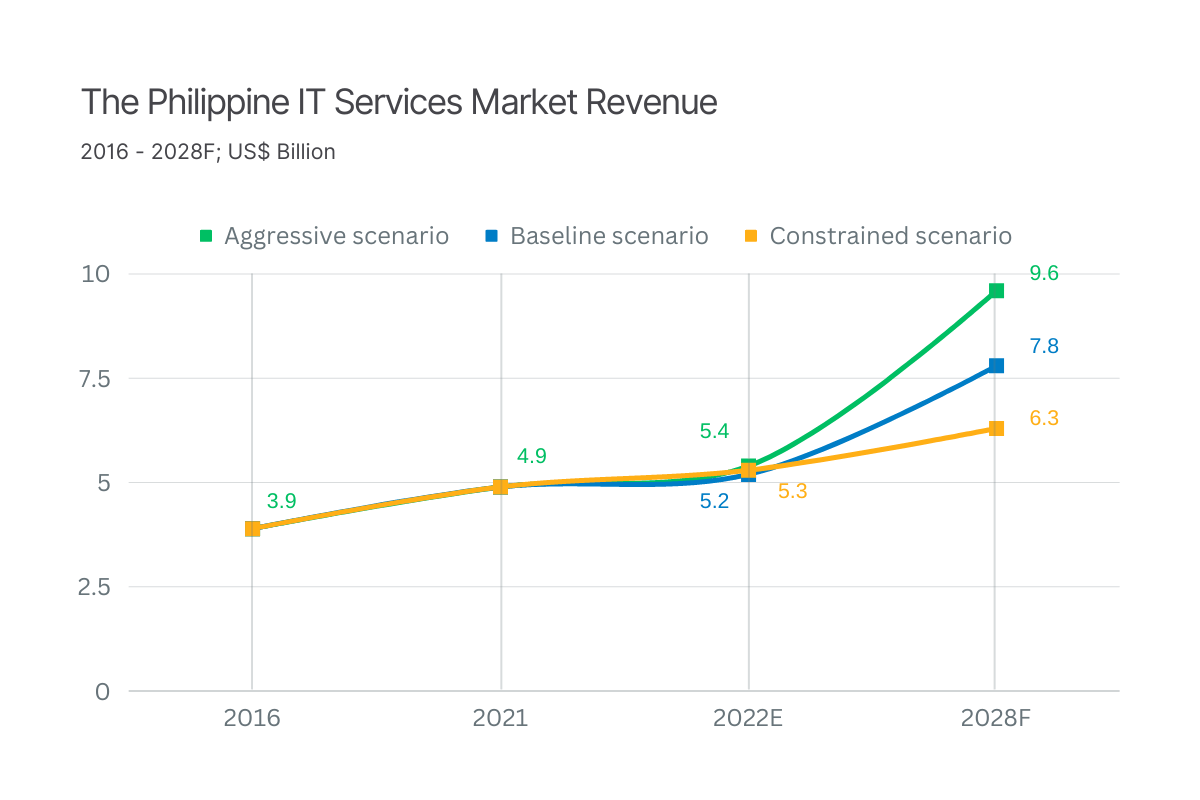

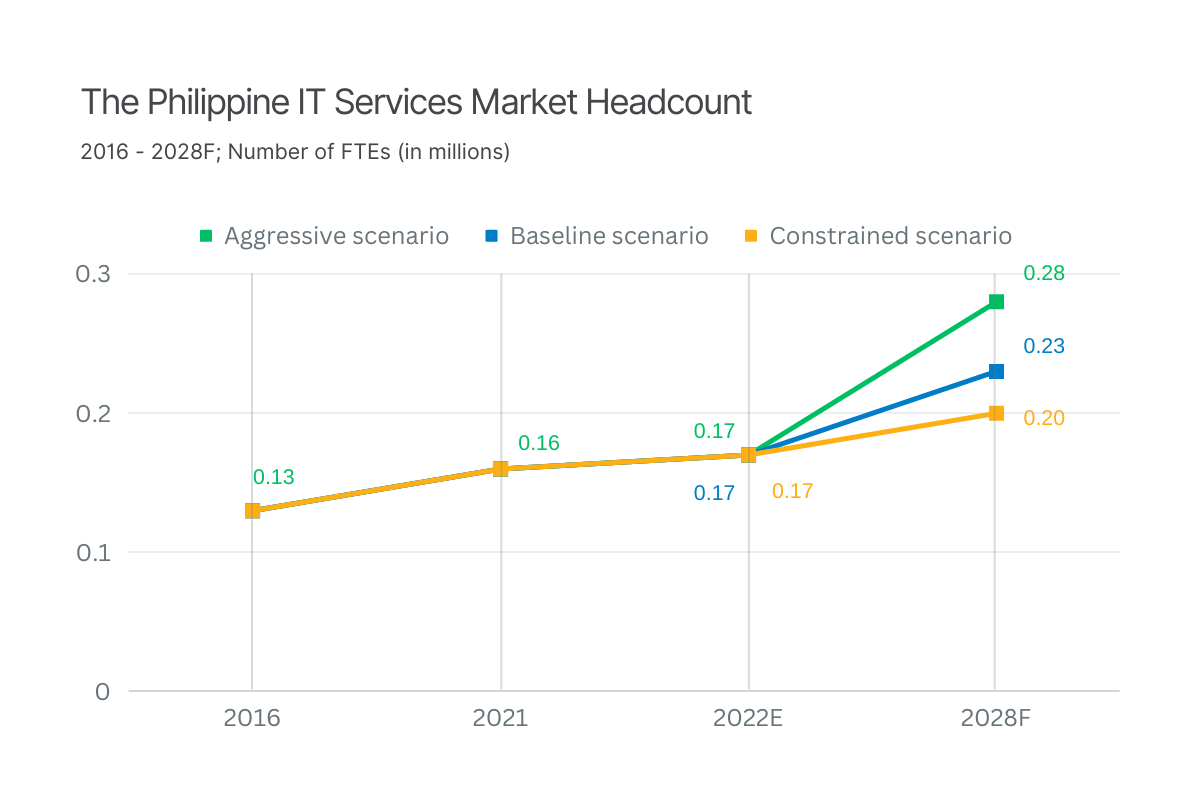

IT Services

The country’s technical support outsourcing strength is in the delivery of common services, such as application data management (ADM) and IT infrastructure. But for several years, the country has expanded into more complex and higher-value services, including cloud computing and cybersecurity.

The rising demand for emerging IT services such as data analytics, artificial intelligence (AI), augmented reality/virtual reality, and blockchain will increase the revenue and headcount of the Philippine outsourcing industry in the next five years, as shown below:

Source: IT-BPM Industry Roadmap 2028 Executive Summary, IBPAP

Notes: 2022E = estimates for 2022; 2028F = forecast for 2028; FTEs = full-time employees

Healthcare Services

The nation is the world’s leading hub for U.S. registered nurses (USRN) in healthcare services. The BPO industry specializes in traditional healthcare processes, including medical billing and collections, care management, and claims management.

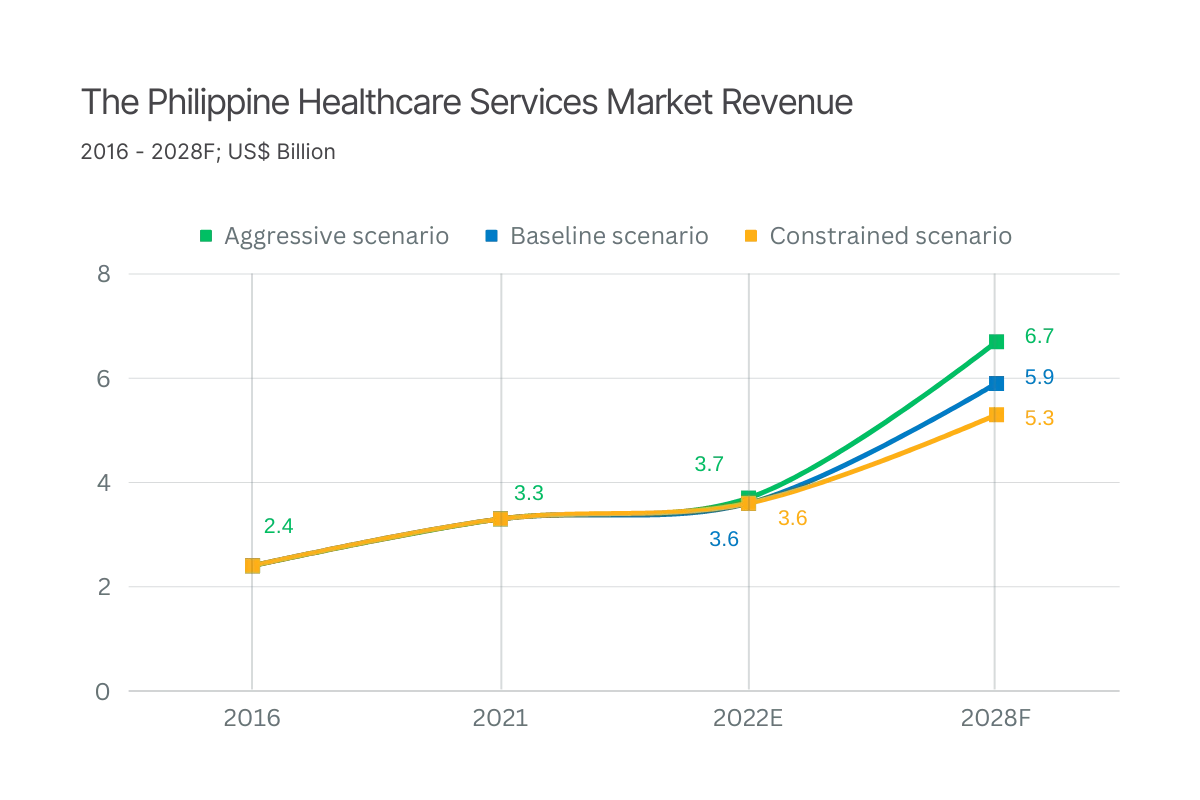

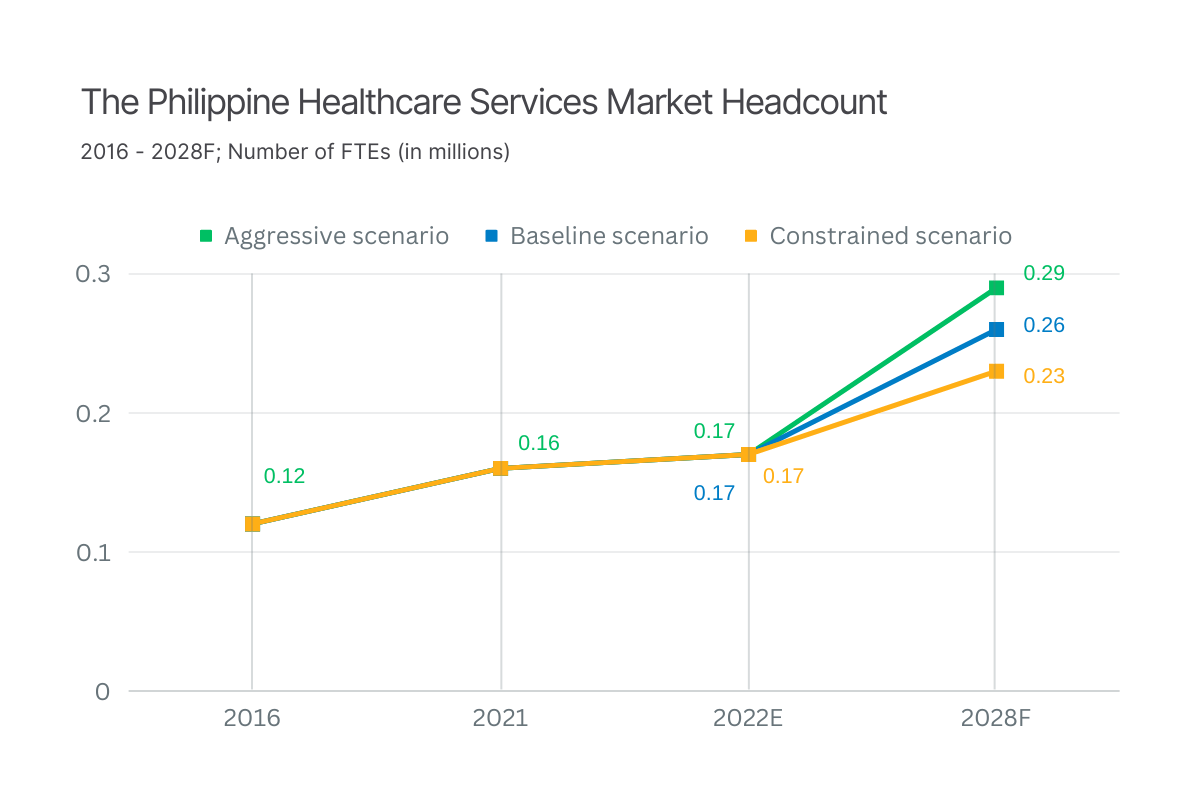

The growing need for high-value services such as life science, analytics, and clinical research will raise the bottom line and the number of staff in the Philippine outsourcing industry by the end of 2028, as shown below:

Source: IT-BPM Industry Roadmap 2028 Executive Summary, IBPAP

Notes: 2022E = estimates for 2022; 2028F = forecast for 2028; FTEs = full-time employees

The Philippine Outsourcing Industry: A Cross-Country Comparison

The Philippines is one of the world’s top outsourcing destinations. See how the country fares with the rest of the leading outsourcing providers.

| English Proficiency Ranking | English Proficiency Score | Literacy Rate(%) | Labor Force Participation Rate(%) | Outsourcing rates(hourly rate in dollars) | |

|---|---|---|---|---|---|

| Philippines | 22 | 578 | 96.62 | 66.6 | $6 to $8 |

| India | 52 | 516 | 72.23 | 48.2 | $5 to $9 |

| Malaysia | 24 | 574 | 94.64 | 69.8 | $5 to $9 |

| Ukraine | 35 | 539 | 99.97 | 61.8 | $12 to $25 |

| Poland | 13 | 600 | 99.79 | 58.2 | $12 to $25 |

| Mexico | 88 | 447 | 94.55 | 60.2 | $8 to $18 |

| Brazil | 58 | 505 | 92.59 | 61.7 | $8 to $18 |

| Argentina | 30 | 562 | 98.09 | 47.6 | $8 to $18 |

English proficiency is the ability to use and understand written and spoken English. A high proficiency and score mean a person can comprehend TV shows or movies, read content, and transact or do business in English.

The literacy rate is the percentage of people aged 15 years and older who can read and write. A high rate means many can be trained to work in various industries, such as the outsourcing sector.

The labor force participation rate estimates an economy’s active workforce. It is computed by dividing the total number of people aged 16 years and older who have or are currently seeking jobs by the total number of the working-age population. The higher the rate, the more skilled labor there is.

The outsourcing rate is paid to a contractor for a particular task. It differs depending on the country. The lower the rate, the more favorable it is for a third-party contractor, as the service provider can offer better rates to clients.

Analysis of the Philippine Outsourcing Industry: Strengths

Consider the advantages of the Philippine outsourcing industry over its counterparts.

Outsourcing-friendly Regulations to Stimulate Business Activities

The Philippine government has assisted the BPO sector since its inception in the early 1990s. It recognizes the industry as a primary contributor to tax revenue, technological improvement, and job generation.

In particular, two government agencies help encourage and simplify the establishment, maintenance, and operations of BPO companies. These are the Philippine Economic Zone Authority (PEZA) and the Board of Investments (BOI). They closely participate in the steady growth of outsourcing activities, whether data entry services or other back-end operations.

Sustained Economic Expansion for Better Yields on Investment

The Philippine economy has grown considerably over the last ten years, posting a 6% increase in real annual GDP since 2010. Sustained GDP growth translates to a strong economy with robust business investments, consumer spending, and government expenditure.

A solid economy means higher stability, resulting in stronger investor confidence and more business opportunities. Outsourcing solutions, such as contact center as a service (CCaaS) and similar operations, benefit from a rosy economic and business environment.

Proficient English-speaking Third-party Staff for Better Interaction

English is the country’s second language, used in most government, educational, and business institutions. The prevalence of this language enables the Philippines to consistently rank among the most skilled English-speaking countries in international surveys.

Collaboration and communication are smoother with workers in the Philippine outsourcing industry. Americans, Australians, Canadians, and other English-speaking Westerners can better understand Filipinos’ English accents. Processing transactions, resolving service issues, and answering questions are also easier with Filipino agents, representatives, or specialists.

Cultural Likenesses for Personalized Customer Relations

Cultural identities affect the success of back-office outsourcing tasks. Filipinos have the same beliefs as Americans and other Westerners. They have similar religious beliefs (e.g., Roman Catholicism, Protestantism, and Christianity), holiday events (Christmas, Holy Week, and Independence Day), and leisure activities (watching Hollywood films and eating hamburgers).

Sharing common interests and expectations enables professionals in the Philippine outsourcing industry to communicate confidently with Western customers and establish friendly relations. These traits give them an edge over other outsourcing countries in providing excellent customer satisfaction.

Moreover, Filipino third-party workers are known for their favorable work qualities. They strive to offer the best service possible. It is innate in them to express warm hospitality to visitors, newcomers, and foreigners. A welcoming and cheerful attitude is part of their culture.

An Abundant Supply of Young and Trainable Talent for Outsourced Tasks

Tens of thousands of qualified, competent, and teachable students complete their formal education at Philippine colleges and universities, training institutions, and technical and vocational centers annually.

Most graduates are from the millennial and Generation Z groups, who are motivated, active, and adaptable. This large pool of young talent can work at any time and place. These groups are proficient in the latest technologies, such as social media, smartphones, and office applications.

The Philippine outsourcing industry will continue to experience an abundant reserve of workers in the foreseeable future.

Improving Digital Infrastructure for Seamless Communication

The country’s internet capability has advanced substantially over the past few years. Major local and foreign internet service providers (ISPs) now deliver fiber-optic or satellite-based connectivity to subscribers nationwide. Stiff competition has increased upload and download speeds on mobile and fixed broadband accordingly.

The government supports the efforts of ISPs to provide internet reliability and a faster connection for businesses, including the Philippine outsourcing industry, by streamlining the application procedures for building permits. This allows telecommunications providers and other tech companies to quickly construct and upgrade communication towers and structures.

Flexible Workforce To Fulfill Nonstop Outsourcing Operations

Professionals in the Philippine outsourcing industry can work at any moment and place when businesses outsource tech solutions, customer service, sales support, and other back-office operations. They are prepared to clock in on holidays, late nights, or weekends to serve clients and end users regardless of location.

Adjusting to a different time zone is acceptable to many Filipino third-party teams. The workers are acquainted with rotating shifts, weekend work, and changing schedules. The difference in standard time is not an issue for them.

Analysis of the Philippine Outsourcing Industry: Potential Risks

Companies and organizations must also know the possible drawbacks of tapping the services of the Philippine outsourcing industry. Here are the common ones:

- Hidden service charges. Some service providers make their clients shoulder unforeseen expenses, hidden rates, or undisclosed costs. They might send clients invoices for unexpected events that increase operating costs, such as staff termination or abrupt and extended work interruptions (e.g., the pandemic).

- Shared private records. Disclosing confidential and sensitive data to a third-party contractor is necessary when outsourcing bookkeeping and accounting, customer service, and tech support. Clients share bank account details, usernames, credit card numbers, and passwords that might be exposed to unauthorized parties.

- Divided team attention. Some service providers in the Philippine outsourcing industry use a single team to serve two or more clients. This setup forces team members to distribute their time, effort, and skills among clients to manage all the assigned processes. Such an arrangement might lead to poor service quality and delivery.

- Insufficient expertise. An in-house team is more knowledgeable about the company’s services, products, and background than a third-party team. Regular employees are more familiar with the business but are more expensive to maintain. Delegating certain activities to others without proper planning might affect the company’s image and brand.

- Less managerial control. Outsourcing to a third-party contractor means organizations must give up some control over the assigned activities. The BPO provider typically uses its standards, methods, and policies to run and handle outsourced processes. It might abandon or rarely use the clients’ in-house procedures.

Analysis of the Philippine Outsourcing Industry: Opportunities

Below are the two recent developments that present opportunities for the Philippine outsourcing industry.

RCEP Agreement for Higher Level of Outsourcing Services

The country officially joined the Regional Comprehensive Economic Partnership (RCEP) in February 2023 when the Philippine Senate ratified the agreement. RCEP is the world’s biggest free trade agreement, covering a third of the global population, with member nations contributing 30% of the worldwide GDP.

RCEP can attract more investments and employment to help the Philippine BPO sector expand into knowledge process outsourcing (KPO), the next stage of outsourcing. KPO services include legal transcription, financial research, and animation game development.

Companies seeking to outsource KPO services can include the Philippine outsourcing industry among their options due to its skilled and cost-effective workforce.

Provincial Relocation for Cost-effective Outsourcing Operations

Property services firm KMC Savills reports that more BPO providers prefer to build their next offices outside of Metro Manila or other major cities in the Philippines. One indication is that vacancy rates are declining in office spaces in the urban areas of Iloilo, Clark, and Cebu.

The BPO sector favoring the provincial markets means service providers can offer reduced rates to clients. Operating in rural areas will decrease office space and salary costs; office rentals and labor costs in Metro Manila offices are higher than in the provinces.

If this trend continues, the Philippine outsourcing industry might build new hubs as the talent pool grows in the countryside. BPO companies relocating to more affordable areas have access to a larger workforce. Decentralization also provides opportunities in untapped markets.

Analysis of the Philippine Outsourcing Industry: Challenges

The following challenges can impede the growth of the country’s BPO sector:

Need for Reskilling or Re-training

Jon Canto, an associate partner at McKinsey & Company, says about five million Filipino workers should be reskilled or retrained in the next seven years, as many jobs will be automated. He added that many companies are accelerating their automation efforts, and more employees use digital technology.

IBPAP’s Madrid notes that the BPO industry needs a nationwide talent upskilling initiative to help enhance the competency of the outsourcing workforce and mitigate the talent gap. One way to achieve this goal is to introduce specialized degree courses to improve the talent supply.

Companies in the Philippine outsourcing industry must invest in upskilling and re-skilling programs. They must provide the workforce with skills beyond what automation and AI can do.

Need for More Supportive Government Policies

IBPAP states that regulatory measures must be relevant and clear to promote a business-friendly environment aligned with global and local market trends. The local BPO sector needs clear-cut government policies that:

- Simplify regulatory compliance requirements to further improve the ease of doing business for the outsourcing industry.

- Ensure the country’s cost competitiveness by offering support via grants and incentives.

- Enable more convenient adoption of the hybrid workplace setup through dedicated remote work policies. The government must ensure the standardization of incentives regardless of whether employees work in the office or at home.

The government must continue its considerable contribution to the Philippine outsourcing industry as the business landscape changes with the rise of new skills, a hybrid workplace model, and competing countries. It must support the BPO industry to ensure its continued growth.

The Bottom Line

Knowing its strengths, potential risks, opportunities, and challenges can give business decision-makers a clearer and better understanding of the Philippine outsourcing industry. Learning about these elements will also enable them to conduct a cost-benefit analysis to guide their outsourcing strategies.

Additionally, companies can enjoy other benefits when outsourcing operations to the Philippines. These include scalable processes to optimize operating costs, multichannel capabilities for uninterrupted customer communication, and low legal and management accountabilities to avoid high financial expenses.

Need more help with outsourcing? Let’s connect and talk about it.