IN THIS ARTICLE

Table of Contents

Processing payments from customers means generating money for your business. As such, you should consider delegating this operation to business process outsourcing (BPO) providers to reduce costs and improve your bottom line. This approach in BPO is called payment processing outsourcing.

Read this article to learn how outsourcing payment processing can help streamline your payment operations.

What Is Payment Processing Outsourcing?

In BPO terms, payment processing outsourcing is when you delegate your payment processes to a third-party service provider. You can delegate such tasks as payment posting, transaction reconciliation, fraud detection, and even customer support to an external vendor. A reputable BPO partner can help streamline payment operations, reduce costs, and increase profits.

But what is BPO? It covers a vast scope of front-office and back-office services. Some businesses might hesitate to outsource payment processing services because they involve financial transactions. But the right BPO company can help simplify, automate, and improve your payment operations.

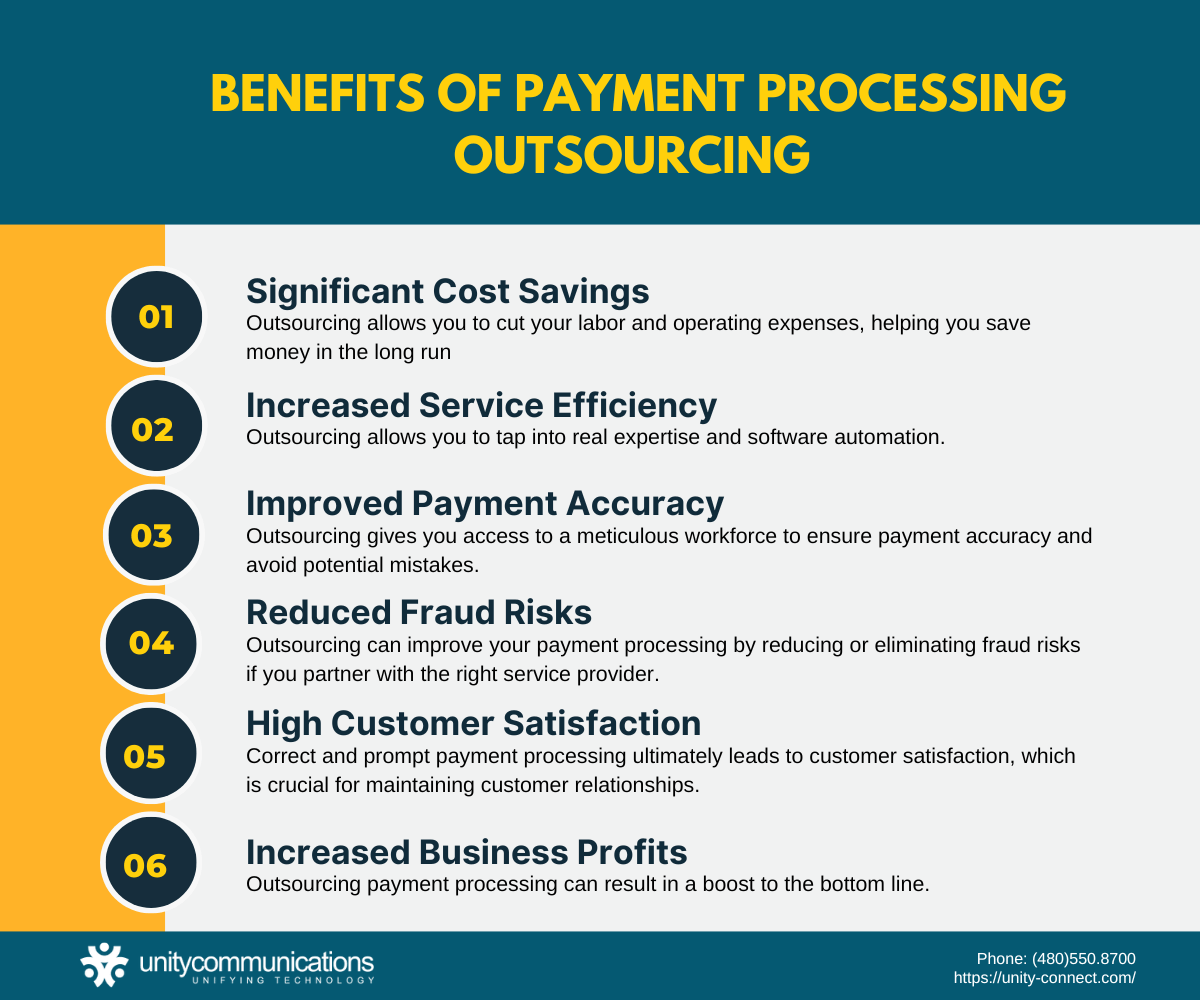

Practical Benefits of Payment Processing Outsourcing

Payment operations play a pivotal role in the functioning of any business. Recent years have witnessed a surge in online banking transactions, marking a significant shift in the financial landscape.

According to Statista, the total transaction value within the digital payment industry is poised to grow substantially, from $11.5 trillion this year to a staggering $16.62 trillion by 2028. This upward trajectory is projected to maintain a steady compound annual growth rate of 9.52% during this period.

For companies seeking to enhance their payment operations and provide robust online banking solutions, collaborating with BPO vendors is wise. Organizations can streamline financial transactions by outsourcing payment processing and improving the customer experience.

Here are several compelling reasons to consider entrusting your payment processing to outsourcing partners:

- Significant cost savings. Managing in-house payment operations can incur substantial expenses. Infrastructure, technology, and staffing demand ongoing investments. In contrast, outsourcing slashes labor and operating costs, offering long-term savings.

- Increased service efficiency.Outsourcing grants access to specialized expertise and powerful software automation. These resources work synergistically to optimize workflow and expedite payment processing, enabling customers to benefit from swift online banking transactions.

- Improved payment accuracy. Errors in payment processing can be costly and lead to delays, additional expenses, and dissatisfied customers. Outsourcing provides access to a meticulous workforce, ensuring payment accuracy and averting potential mishaps.

- Reduced fraud risks. Unsecured payment portals and careless processing expose businesses to fraud risks. Collaborating with the right BPO service provider can enhance payment processing security and significantly mitigate or eliminate fraudulent activities.

- High customer satisfaction. Outsourcing to a dependable BPO provider streamlines payment processing, ultimately boosting efficiency and accuracy. Timely and accurate payment processing translates into satisfied customers, a critical factor in nurturing strong customer relationships.

- Increased business profits.Outsourcing payment processing can have a substantial positive impact on your bottom line. Partnering with a reputable BPO ally cuts costs, minimizes fraud risks, enhances efficiency, and elevates customer satisfaction. These combined advantages contribute to a consistent cash flow, ultimately bolstering your business’s profitability.

How To Choose the Right BPO Provider for Your Payment Processing

You can engage in three types of BPO for your payment operations: onshore, nearshore, and offshore outsourcing. But the success of your outsourcing engagement boils down to partnering with the right BPO vendor.

So here is how to pick the right BPO provider for your payment processing:

- Examine your current payment processing. The goal is to identify the pain points, inefficiencies, and bottlenecks in your payment operations. You can determine specific tasks to outsource and set your particular outsourcing requirements by conducting a thorough examination.

- Look for potential service providers. To do this, you have three options. First, search online to see which outsourcing companies offer payment processing services. Second, ask for recommendations from other businesses or professionals. Lastly, attend outsourcing industry events and work with consultants to create a list of prospects.

- Evaluate human and technological resources. Choose a BPO service provider whose workforce has a financial background. Opt for a provider offering electronic payment systems, mobile payment apps, and digital wallets. Ensure it employs next-generation technologies such as biometric verification and blockchain.

- Assess customer support services. Customer service is a critical component of payment operations. Customers contact businesses to send inquiries, process payments, and get status updates. If possible, look for a BPO partner with a dedicated call center operating 24/7.

- Check for security and compliance. Anything related to money should be completely secured and protected. So when looking for a BPO provider for your payment processing, your prospect should have data privacy, network security, and regulatory compliance protocols.

- Consider the pricing model and cost. Choose a BPO partner with a favorable pricing structure, whether a fixed price (FP), staffing, or time and materials (T&M) model. Remember that the goal is to reduce costs and save money in the long term.

- Choose the right BPO service provider. Finally, you have reached the last and most crucial step. After evaluating your prospects based on the abovementioned factors, it is time to select a BPO partner. Once done, help them set up your payment operations and track your outsourcing progress.

Best Practices for Payment Processing Outsourcing

The global payment market could grow from $561.77 billion in 2022 to $612.04 billion this year at an 8.9% CAGR. Worldwide transactions will continue to grow, seemingly heading toward a cashless society.

Companies outsourcing payment processing should implement best practices to streamline operations and gain a competitive advantage.

Here are some recommendations for you:

- Offer multiple payment methods. Do not accept only credit and debit cards as payment options. Consider electronic fund transfers, mobile payments, digital wallets, and cryptocurrencies.

- Provide flexible payment solutions. Consider offering recurring payments, payment schedules, and even payment plans to help customers manage their finances well.

- Maintain transparent pricing. Gain customers’ trust and prevent billing disputes by being transparent about all fees, transaction costs, and payment terms.

- Use a secure payment gateway. Choose payment portals with encryption and tokenization capabilities to ensure the highest level of security.

- Ensure PCI compliance. Evaluate your payment processing systems regularly to ensure compliance with Payment Card Industry Data Security Standard (PCI DSS) requirements.

- Protect customer data. Use encryption, password protection, and access controls to prevent unauthorized access to customer payment information.

- Set fraud prevention measures. Implement fraud detection software, transaction monitoring, and chargeback prevention policies to reduce fraudulent activities.

- Utilize software automation. Consider automating invoicing, billing, and reconciliation for payment efficiency and accuracy.

- Train staff on best practices. To keep BPO staff informed and accountable, provide them regular training on payment processing procedures, security measures, and fraud prevention.

The Bottom Line

Seeking the help of a BPO company and outsourcing your payment processing are cost-effective solutions for streamlining your payment operations. Follow the steps and best practices here when choosing a service provider.

Your BPO partner can increase payment processing productivity, accuracy, and timeliness using these suggestions. It can help you save money, increase revenue, and make your customers happier.

Looking to streamline your operations? Reach out to us, and let’s connect! Unity Communications is a BPO company that offers reliable payment processing services to help manage your financial transactions and improve your cash flow.