IN THIS ARTICLE

Contents

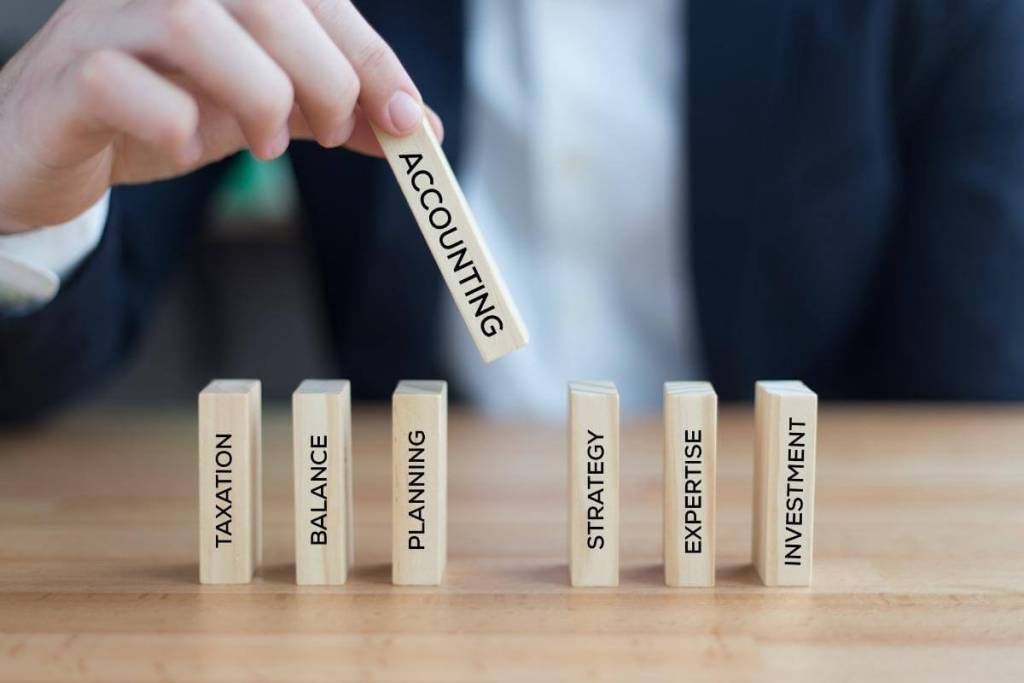

An organization’s accounting operations are a critical part of achieving and maintaining success. This pushes leaders and executives to keep an accounting structure in-house with management in control. But, it is because of this intrinsic value that accounting processes hold that businesses should consider outsourcing this function.

In this guide, we will discuss how you can outsource accounting, decide which areas of finance and accounting to outsource, how to select an outsourcing partner and the effect of outsourced accounting on the valuation of your company.

Why Outsource Finance and Accounting Processes?

As awareness about outsourcing improves and demand increases, outsourcing has grown to be more accessible for businesses of all sizes. The reasons behind outsourcing accounting and finance functions vary from one organization to another, but a few common threads exist for all:

More Focus on Main Functions

Regardless of how critical they are, accounting and finance offer a company no competitive advantage against its competitor unless the aforementioned processes are the company’s core offering. Fulfilling the functions internally means you need to spend a considerable amount of time and money on recruitment and training programs for your employees. Key decision-makers in your organization might also need to take on double duties to accomplish all accounting needs. Either way, those valuable resources are being sidetracked from the company’s main competencies to keep supplemental portions of the operation running smoothly. Getting rid of these burdens by outsourcing accounting to external talents who are just as qualified enable you to remain focused on your business’s most important tasks – those that actually contribute to your competitiveness.

Streamline Accounting Processes

Accounting and finance may not always find a way to keep up as your business scales up, downsizes or changes in any way. Contrasting systems and the lack of employee attrition all contribute to ineffective accounting and bookkeeping. By letting a reputable outsourcing company take over, you can utilize in-built universal documentation where the byproduct is a more streamlined accounting process.

Counterbalance Talent Scarcity

The finance industry is currently facing a pipeline problem that is predicted to be even more challenging in the next coming years. Therefore, outsourced accounting and finance are greatly positioned for success, especially with international outsourcing models. According to the American Institute of Certified Public Accountants (AICPA), 75% of currently employed certified accountants will retire in the next 15 years. They predict a shortage of next-generation candidates to replace these professionals. However, in growing markets like the Philippines, accounting and finance are still seen as reputable career choices, and any of the candidates are as qualified as stateside accountants.

Reinvest Time

For business leaders and executives, time is considered a valuable resource in the same way that money is. When you choose to outsource accounting, you can allocate the time you are no longer spending on repetitive and manual peripheral tasks elsewhere. You can instead invest the time in value-adding operations, divestitures, or in nurturing stakeholder relations.

Keeps Cost Low and Increases Savings

Finance and accounting outsourcing is a great way to keep costs down for many businesses for many reasons. Comparable wage in offshore markets tends to be much lower than in the US. With outsourcing, many of the usual expenses that come with in-house labor are bypassed. Many companies that choose to outsource find that they can then work with industry experts without the need to choose between quality and financial burdens.

Which Accounting Functions can be Outsourced?

A misconception about outsourcing finance and accounting is that it requires an all-or-nothing approach. But this is far from the truth. Many companies opt to test the waters by outsourcing a small set of processes or even just one accounting task at a time. As was mentioned earlier, the primary reason for migrating to an outsourced accounting model is to free up the time of in-house employees, to achieve optimized distribution of workload, and to focus more on value-adding tasks. This is why many companies often begin outsourcing with recurring and transactional functions in order to examine the benefits and potential challenges of working with an outsourcing firm. Some examples of highly transactional and highly repetitive tasks are accounts payable and account receivable.

These two functions require manual processes and the rate of employee attrition is high, forcing businesses to regularly seek new talent to perform these functions as employees move up or out. Downtime and loss in productivity are common. The cost of recruitment in an already scarce market is another driver for outsourcing accounts receivable and accounts payable.

Without outsourced finance and accounting, much money often goes down the drain due to routine bookkeeping processes. Finance and accounting outsourcing allows you to allot expensive talent to high-judgment accounting tasks while your BPO partner handles the scouting, training, and deployment of talent in offshore areas with less competition and less compensation inflation.

How you can outsource accounting processes will ultimately vary with your business needs. Even so, here is a non-exhaustive list of additional transactional accounting tasks you can consider outsourcing:

-

- Expense reporting

- Fixed asset reporting

- Account reconciliation

- Payroll

- Tax filing

- Month-end close

- Procure-to-pay

- Intercompany accounting

Although you may feel most comfortable letting go of these low-value accounting functions, don’t think that these are the only tasks outsourced accountants can handle. Take note that the labor environment in markets such as the Philippines has much-qualified talent and high-level accountants who can handle senior-level operations. This is highly beneficial for businesses that want to scale up quickly or for small- to mid-sized businesses that suffer from the effects of labor scarcity causing those with the needed skills to be inaccessibly expensive.

Some high-level tasks you can consider outsourcing include:

-

- Debt management

- Budgeting and forecasting

- Audit reporting

- Process oversight

- Treasury and risk management

- Data extraction and management

Learn more: 4 Business Options for Outsourcing Finances You Should Consider

Choosing the Right Outsourcing Partner

If you’re interested in outsourcing accounting, you first need to select the best outsourcing partner for your needs. To do this, you first need to identify your business needs, assess your company budget, and look for providers who are up to par with your standards. Narrow your hunt by only searching outsourcing firms you can afford, those with security compliance and data protection measures, and high-quality software and infrastructure.

Don’t forget to check client reviews and testimonials. Make sure to conduct all aspects of due diligence. Keep an eye out for other businesses in the same industry that your selected firm has worked with, and read what they have to say.

Lastly, conduct a trial project with the outsourcing partner you selected. In doing so, you can assess their performance and see how well they fit your business requirements.