Table of Contents

Learn more about outsourcing services for Phoenix businesses. Watch the video below.

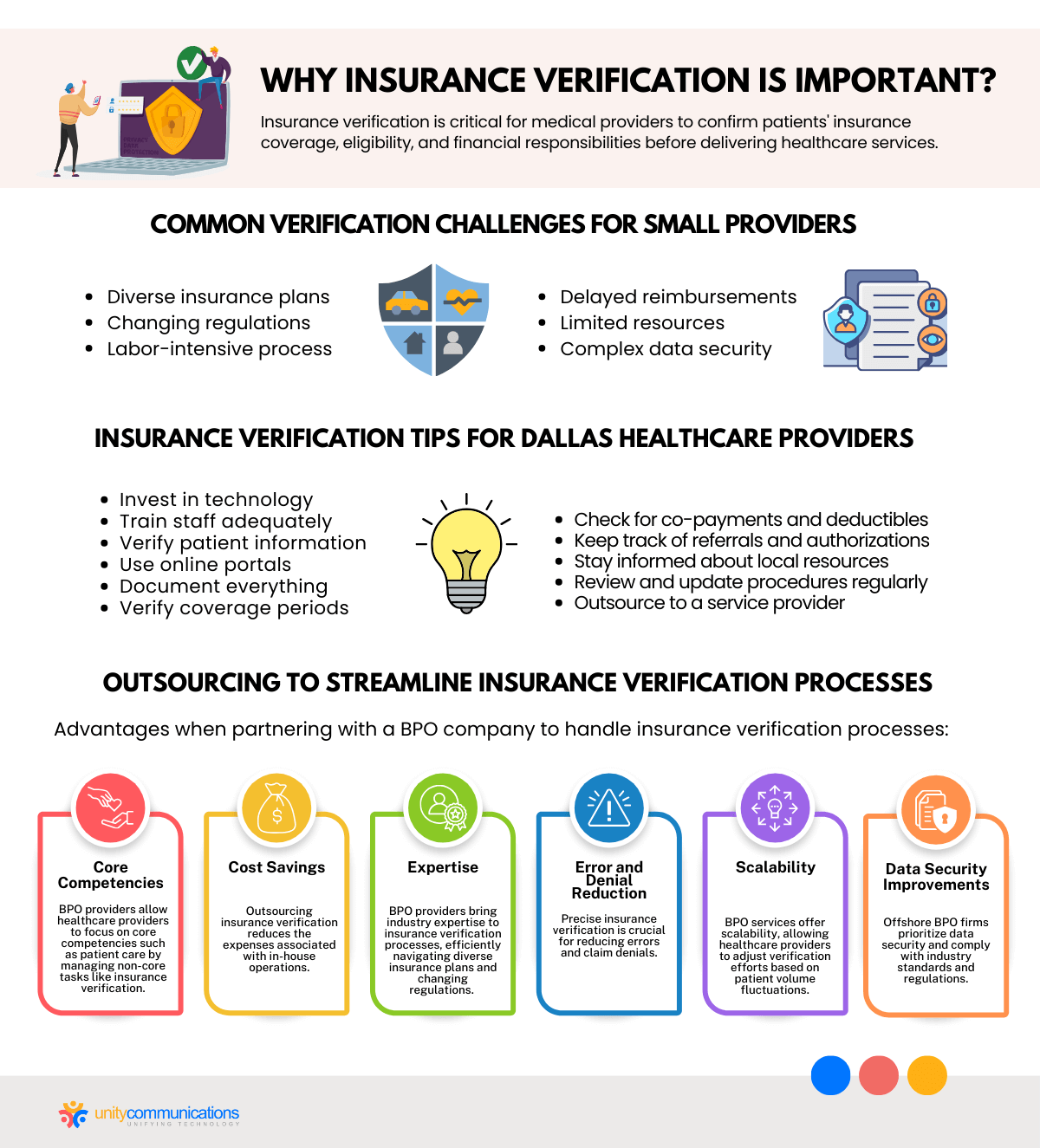

Insurance verification is pivotal for small healthcare providers in Dallas because it contributes to financial stability and patient satisfaction. This complex and resource-intensive activity involves navigating diverse insurance plans and regulations.

Local medical providers can seek out third-party vendors and virtual assistants in Dallas, TX, to tackle these challenges effectively. They offer a strategic advantage in streamlining insurance verification processes to improve accuracy and ensure timely reimbursements.

This article explores how small Dallas providers can excel in a competitive healthcare environment with a few key insurance verification tips.

Keep reading to learn more.

Healthcare Labor Crisis in Dallas Risks Insurance Verification Processes

North Texas, where Dallas and Fort Worth are located, faces a substantial staff shortage in the healthcare industry.

In particular, the demand for nurses in the region is currently surpassing supply, according to the Texas Department of Health and Human Services. The gap is anticipated to expand in the coming years. Unmet demand in the state presently stands at 11.5%; the shortage is predicted to be 16.3% by 2032.

A severe workforce shortage has ripple effects on Dallas-based small healthcare providers and their insurance verification processes. They will likely need help conducting insurance verifications quickly or else risk delays and potential mistakes. This scarcity can cause backlogs and impede prompt reimbursements, threatening small healthcare providers’ profitability.

Why Insurance Verification Is Challenging for Dallas Medical Providers

Insurance verification confirms a patient’s insurance coverage, eligibility, and financial responsibilities before providing healthcare services. This process poses a serious issue for small medical providers in Dallas. The city’s complex and dynamic insurance environment presents several obstacles:

- Diverse insurance plans. Dallas residents have a wide range of insurance plans, from private to government programs, such as Medicare and Medicaid. Small providers must navigate this insurance maze, verifying each patient’s eligibility accurately and efficiently.

- Changing regulations. Healthcare regulations in Texas can be intricate and subject to frequent changes. Small providers must stay updated on state and federal regulations to ensure compliance. Non-compliance can result in legal and financial consequences.

- Labor-intensive process. Insurance verification is a time-consuming and labor-intensive process. It demands dedicated staff resources to confirm patient coverage, benefits, co-payments, and deductibles for various insurance plans. This process diverts attention and resources away from patient care.

- Delayed reimbursements. Late payments from insurance companies can strain small providers’ cash flow. Timely and accurate verification is essential to prevent these delays so the providers receive the compensation they deserve.

- Limited resources. Small healthcare providers might have insufficient resources to effectively manage insurance verification. Without dedicated personnel and appropriate software solutions, they might struggle to navigate the complexities of insurance verification.

- Complex data security. Handling sensitive patient information during the verification process poses data security concerns. Small providers must ensure compliance with healthcare data security regulations to protect patient confidentiality.

Dallas Provider Insurance Verification Tips to Use

Small medical organizations must implement effective insurance verification practices to survive and grow. Dallas healthcare providers can consider these insurance verification tips when navigating challenges and optimizing operations:

Invest in Technology

Investing in technology might seem too costly for small Dallas medical providers, but it is an essential insurance verification tip. Advanced software solutions and electronic health record (EHR) systems with built-in verification capabilities speed up the process, eliminate mistakes, improve efficiency, and allow real-time validation.

Given the diversity of insurance plans and Dallas’ complex regulatory environment, relevant technologies are vital. With the latest tools and solutions, small providers can improve competitiveness, cut operating expenses, and assure accurate and rapid insurance verification. They can also help medical practices focus on delivering top-quality patient care.

Train Staff Adequately

A valuable piece of insurance verification advice for small healthcare providers in Dallas is prioritizing employee upskilling. Proper training ensures that team members comprehend the complexities of various insurance plans and the need for precise verification. It also assists them in complying with Texas healthcare laws.

Correctly educated staff members can decrease errors, avoid claim denials, and raise efficient operations, eventually adding to small providers’ financial stability and reputation in a competitive, ever-changing healthcare market like Dallas.

Verify Patient Information

For Dallas healthcare providers, a key part of insurance verification is double-checking patient information. So this tip is more of a reminder: always ensure patient details, including full name, date of birth, and contact information, align with insurance records. Confirming these details is vital, as different insurance plans and patient backgrounds can introduce complexities.

Precise patient information verification proactively prevents discrepancies, claim denials, and revenue loss. For instance, a hospital in Texas discovered that 22% of its patient documents were duplicates, according to the Healthcare Financial Management Association. Duplicated records are one of the grounds for claim denials.

Use Online Portals

Small Dallas providers should consider leveraging online portals as a critical insurance verification tip. Many insurance companies offer these digital platforms, enabling providers to access real-time patient eligibility and benefit information. They can expedite the verification process to streamline appointment scheduling and patient care delivery.

Online portals enable instant access to critical data in Dallas’ varied insurance environment, lowering the likelihood of mistakes and ensuring that physicians are well-informed about patient coverage and financial responsibilities. Follow this advice to streamline operations and improve the overall patient experience.

Document Everything

Retaining comprehensive records of all insurance verification operations, correspondence with insurance providers, and validated information is critical. Detailed documentation provides legal protection and transparency in a dispute, audit, or claim denial.

Complete documentation also improves accountability, supports the verification process, and assures compliance with healthcare legislation. This approach is critical in Dallas’ competitive healthcare scene. It helps sustain financial stability and safeguard the integrity of patient information, strengthening the trust and confidence of patients and doctors.

Verify Coverage Periods

Checking coverage periods is a vital step Dallas healthcare providers take in insurance verification, but it is just the tip of the iceberg. This technique guarantees that patients’ insurance is active and reduces the danger of delivering treatments to individuals whose coverage has lapsed or lost legitimacy.

Knowing the correct coverage period helps prevent claim denials, revenue loss, and billing mistakes in Dallas’ healthcare industry, where residents routinely switch insurance policies. Providers can keep efficient revenue cycles, lower financial risks, and retain the integrity of their billing procedures while delivering ongoing patient care by precisely confirming coverage terms.

Check for Co-payments and Deductibles

Determining patients’ financial responsibility helps provide billing integrity and avoid misconceptions. Due to the variety of Dallas’ insurance plans, understanding co-pays and deductibles is necessary to prevent billing problems and unexpected patient charges.

Payments can be collected at the point of care for small providers, enhancing their revenue cycle and lowering the risk of bad debt. Rigorously scrutinizing co-pays and deductibles improves patient happiness, maintains financial stability, and builds a trustworthy patient-provider relationship in the competitive Dallas healthcare scene.

Communicate this information to the patient before providing services to prevent surprises and potential disputes over billing.

Keep Track of Referrals and Authorizations

What else should Dallas medical providers accomplish as part of insurance verification? Here is a tip: Specific insurance plans, particularly health maintenance organizations (HMOs) and managed care programs, require patients to obtain referrals or pre-authorizations before seeking specialty care or medical services. Thus, providers monitor referrals and authorizations.

To avoid claim denials and reimbursement delays, ensure these requirements are met before treatment delivery. Careful tracking and adherence to referral and authorization protocols promote compliance with insurance company policies and help maintain smooth and efficient operations in the Dallas healthcare sector.

Stay Informed About Local Resources

The Dallas healthcare market offers access to medical associations, educational workshops, and online forums that provide insights and support. Networking with local organizations and professionals keeps providers updated on industry trends, regulations, and best practices specific to the city.

These resources provide a wealth of knowledge, helping small providers navigate the complexities of insurance verification in the area effectively. By tapping into local expertise, they can enhance their verification processes, ensure compliance, and sustain financial stability while serving the diverse healthcare needs of the Dallas community.

Review and Update Procedures Regularly

The ever-evolving healthcare setting and changing insurance regulations necessitate continuous adaptation. Periodic assessments of verification processes and protocols enable medical practices to align with current industry standards and state-specific rules.

Small providers can streamline their operations, reduce errors, and improve their compliance and financial security by remaining proactive and making the needed adjustments. The ability to evolve and refine insurance verification procedures is essential for healthcare firms to stay efficient, competitive, and focused on delivering top-notch patient care.

Outsource to a Service Provider

Dallas healthcare providers should consider delegating insurance verification functions to a business process outsourcing (BPO) provider as a strategic insurance verification tip. The complex, labor-intensive nature of insurance verification can strain the resources of small practices.

By partnering with a healthcare BPO provider, small medical organizations can access skilled experts and advanced technology and achieve more streamlined processes. These factors reduce costs, improve efficiency, and ensure accurate verification.

Keep reading to discover why Dallas providers consider outsourcing vital for insurance verification and learn a few tips to ensure a successful partnership.

Outsourcing to Streamline Insurance Verification Processes

So what is the BPO’s role in the insurance verification operations of small healthcare providers in Dallas?

Third-party providers specializing in healthcare BPO services can manage administrative, operational, or non-core tasks within the medical space. Their services include non-medical operations such as billing, coding, revenue cycle management (RCM), medical transcription, claims processing, accounting, information technology (IT), and insurance verification.

Outsourced services are often carried out through offshoring, which involves contracting tasks to service providers in distant countries (e.g., the Philippines), or nearshoring, which taps providers in neighboring regions (e.g., Mexico or Puerto Rico). It allows healthcare organizations to devote time and effort to patient care and treatment.

Consider some advantages when partnering with a medical nearshore or offshore outsourcing company to handle insurance verification processes:

- Core competencies. Outsourcing insurance verification empowers healthcare providers to prioritize patient care quality by reallocating resources to enhance clinical services, patient base, and overall patient experience. It helps foster better outcomes and business growth.

- Cost savings. In-house insurance verification can be costly, requiring recruitment, tech investments, and infrastructure. Outsourcing reduces these expenses, as specialized providers supply efficient, cost-effective expertise and technology.

- Expertise. Delegating insurance verification processes connects small healthcare providers with industry experts. These specialists easily navigate diverse insurance plans and changing regulations, reducing claim denials for complex cases.

- Error and denial reduction. Precise insurance verification is critical. Outsourcing providers stay current with industry changes to improve accuracy and reduce errors. Their up-to-date knowledge leads to a marked decrease in claim denials, saving time and expenses associated with appeals and resubmissions.

- Scalability. Small healthcare providers face patient volume fluctuations. Outsourcing provides scalability. During peaks, verification efforts can increase without in-house hiring. They can also adjust costs as needed during lulls.

- Data security improvements. Offshore BPO firms prioritize data security, complying with industry standards and regulations. Their advanced security measures safeguard patient data. Small providers mitigate the risk of breaches and ensure patient privacy when assigning insurance verification processes.

- Patient experience advancement. Efficient insurance verification enhances transparency and promptness. Outsourcing fosters trust and reduces misunderstandings, improving the patient experience.

- Compliance and legal protection. Outsourcing experts are versed in regulations. In disputes or audits, a dependable partner offers vital legal protection for small providers.

- Industry adaptability. Healthcare evolves with new rules, plans, and tech. Outsourcing adapts fast, integrating software, updating processes, ensuring compliance, and saving providers time and effort.

The Bottom Line

Dallas healthcare providers can benefit from the insurance verification tips listed above. In particular, outsourcing is a standout strategy.

By partnering with offshore or nearshore BPO providers, healthcare practices can streamline insurance verification to reduce costs and improve the accuracy of tasks. Outsourcing offers scalability, data security, expert access, and financial stability.

However, healthcare providers should be well-informed about the pros and cons of outsourcing services to make better decisions that align with their goals and priorities.

Let’s connect if you want to learn more about insurance verification tips for optimizing your Dallas healthcare practice’s efficiency and success!